Casks have become an increasingly popular alternative investment over the last few years. If you are looking to buy a cask of whisky in 2023 there are 6 things to think about before you purchase to make sure your money is safe and able to work for you over the long term.

1: A delivery order will keep you safe

If you only read one tip on cask investment then understanding delivery orders is the one to focus on. We have been advocating for delivery orders for a long time, and have been featured in the likes of Forbes talking about how important it is to take full ownership of your cask.

A delivery order, signed by the buyer and seller of the cask and acknowledged by the warehouse is the industry standard way to transfer ownership. If you have received a certificate of ownership, a deed of title, or anything that isn’t a signed document acknowledged by the warehouse, then chances are that you do not own your cask at the warehouse level. If you don’t own your cask you cannot verify its existence with the warehouse and you do not have full control of your asset, and therefore your money.

For a full lowdown of why you need a delivery order please watch this video. Hopefully you agree that not owning an asset does not sound like a sound investment foundation and is one to be avoided.

2: Duty representatives are for overseas businesses

Some brokers who are unable to provide a delivery orders are instead suggesting that they can act as a duty representative as a legal alternative. This is simply wrong. Unsure if you need a duty representative? just take our simple quiz:

Are you a business based outside the UK?

-

- Yes

- No

If you answered no, then you do not need a duty representative.

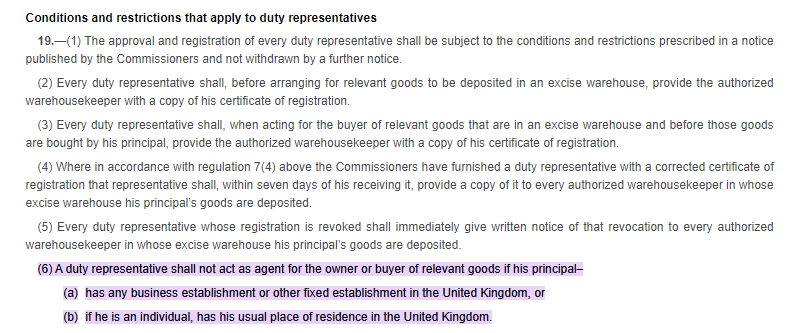

If fact, if you are a UK resident or have any kind of UK based business then the bit of legal paperwork governing the warehousing of duty suspended goods (see here, or here, or check out the excerpt below) specifically says that someone cannot act as your duty representative. If you are UK based and someone is saying that they can be your duty rep as a legal solution to not providing a delivery order then please consider whether they are a suitable source for buying a cask.

3: Check the price you are paying

There is not a lot of readily available information on cask value or how to calculate it. With some digging around on online whisky auction sites you can find auction prices for a limited number of cask sales. However, these can be widely variable because consumers do not understand cask value, so they are not always the most reliable comparison source.

If you want to check the price you are paying you can use our cask calculator to create a per bottle price, which you can then add a margin to and compare to wholesale independent bottling prices. This allows you to independently verify the price you are paying. This should be especially useful for older casks, and any cask where the price is varying significantly at auction.

If it is a young cask you can also compare the price you are being asked to pay to the price of new make casks that are available direct from some distilleries.

4: Casks are a long term investment

Cask investments take time in order for the cask to reach a premium age and benefit from other potential increases. Casks should be looked at as a minimum of a 10 year investment, and ideally you should aim to sell when your cask is 18 years or older in order to make the most from your investment.

The only way to shorten the time frame of the investment is to buy a slightly older ‘young’ cask rather than new make. This is a strategy that we can help buyers with as we aim to source 3 – 10 year old casks.

Some brokers will suggest buying casks over 10 years old as a way to further cut the investment time frame. Unfortunately the decision to buy a young or teenage cask over a new make cask should not be made without making sure you are abiding by tip 3; ensure you are paying a fair price.

5: Have you got the right name?

Branding is incredibly important in all marketing and within the whisky industry it can be the difference between a cask being worth a few thousand pounds and a hundred thousand pounds. When buying a cask you can position yourself to take advantage of this by ensuring you purchase a cask with full naming rights. This means you can take advantage of the brand the distillery has already built and receive a premium from your cask when you come to sell it.

Some casks are sold without full naming rights because they are intended for blending or other lower value work. It is therefore very important to check your contract for this information as it dramatically impacts the eventual price of your whisky cask. Often this can be masked by the broker or dealer by using other pseudonyms for the distillery without explicitly explaining the difference that will make to your eventual returns.

Names that should make you question your dealer or broker about naming rights are: Stoaisha, Whitlaw, Kirkcowan and Orkney Malt among others. If you are unsure whether the cask you are looking at has the correct naming rights please feel free to get in touch and we will be happy to help

6: If it sounds too good to be true it probably is

Caution over NFTs was our new tip for 2022, and although time has proven us right on that one, the lessons to be learnt from that market are still applicable to casks in 2023. Basically, if something looks too good to be true, then it likely is.

Like NFTs and crypto currencies did in early 2022, casks have become increasingly popular as an alternative investment thanks to publicity around the returns of a few lucky investors. The reality is that, just like NFTs and crypto, while it is true that a few lucky investors have made a huge return, most will make modest profits over a long term. So diving into casks because you think you can make a quick £100,000 is unrealistic.

If a dealer or broker is promising you huge returns over a short time frame ask yourself why they are offering you that investment rather than investing their own money. If they have a satisfactory reason and you are happy with the other 5 points raised in this article then proceed if you wish. However, our closing comments for this tip would be to always remember that cask investment is an unregulated market and if you aren’t 100% certain then do further checks.

Those are our six quick steps to investing in a whisky cask in 2023. If you want more details about how to invest in casks then you might be interested in downloading our free cask investment guide. You can also get in touch with us at [email protected]