If you want to buy a cask of whisky then welcome, whisky casks can be a rewarding asset in terms of both potential returns and experience.

The process of buying a cask is relatively simple: choose a cask, pay for it and then the seller will notify the warehouse so that you become the new register owner. The last part is usually done via a delivery order—some warehouses accept other methods, but as per the SWA we suggest checking with the warehouse directly if you’re not sure what they accept.

The process of buying a cask of whisky is simple. However, like any new venture, deciding whether to buy and equipping yourself with the knowledge to make the right investment for you is what takes the most time.

In this guide we break down the fundamentals of buying a cask of whisky into six easy to understand sections, from the basic principles, to where to buy and a quick intro into selling a cask.

If you want more information please make sure you download our free PDF Cask Buying Guide, explore the further reading for each section or visit our dedicated online library of our key articles on how to buy a whisky cask.

Send me my free cask buying guide

"*" indicates required fields

One: The Principles Of Cask Investment

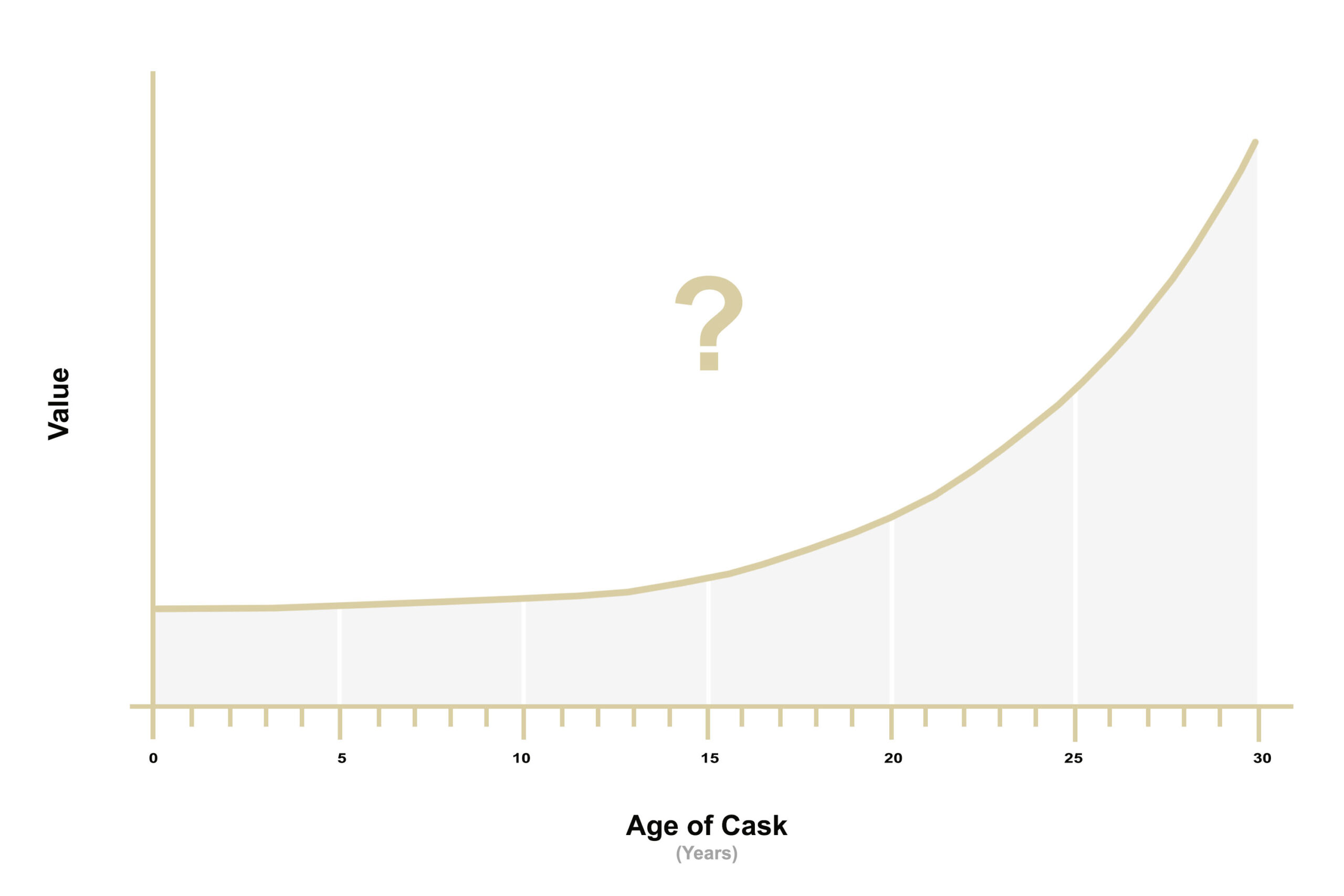

The basis for investing in whisky is simple: older whisky is worth more than younger whisky. The foundation of any cask investment is to buy a young whisky and sell it when it’s older.

Within this basic foundation there are a few things you need to consider, risks to be aware of and considerations to take in terms of where you buy and how long you need to hold a cask.

Further reading: Are Whisky Casks A Good Investment?

Two: The Benefits And Risks Of A Wasting Asset

It is important to understand that you cannot mature whisky in a cask indefinitely and the endpoint for all casks is bottles.

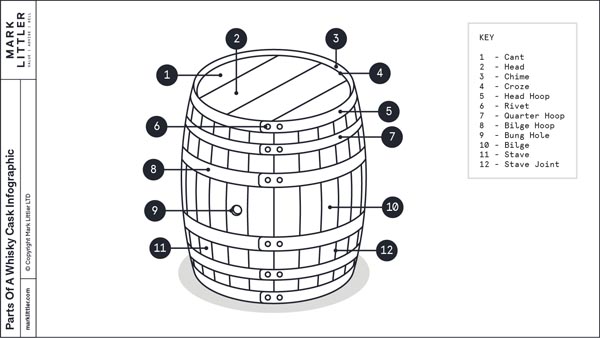

Casks are vessels made from wooden staves and a natural part of the maturing process for whisky is evaporation and, for scotch whisky, a drop in ABV over time. This means that if left indefinitely the whisky in a cask will evaporate to the point that it is worthless. Plus scotch whisky has to be over 40% to be classed as whisky. Under normal circumstances casks are deemed therefore to have a finite lifetime of 50 years or less and are classed as a wasting asset.

The benefit of this is that wasting assets are exempt from capital gains tax.

However it also means you can’t just buy a cask and ignore it. We suggest checking your cask via a regauge every 3 to 5 years as your cask matures.

Further reading: What Is A Regauge? and Whisky Casks And Capital Gains

Three: How Long Do You Want To Invest For?

Whisky casks are a long term investment. We wouldn’t suggest buying a cask of whisky unless you are comfortable with locking that money away for at least 10 years.

You should aim to get your cask to at least 15 to 20 years old in order to benefit from the increase in quality and scarcity that happens in the late teenage years.

From our experience helping people sell their casks of whisky you can look at the following start points:

Young Whisky: 10 – 12 year investment

Buying young whisky aged around 3 to 10-years-old gives you the benefit of a head start that allows you to aim for a roughly ten year investment. This is what most of our investors prefer. It does necessitate a slightly higher initial purchase cost, but it still offers a good value starting point and good potential returns.

New Make: 15 – 20 year investment

We take a small allocation of new make spirit to offer to customers who want a cheaper starting point but understand that they need to hold the cask for a minimum 15 year period. This is the cheapest way to buy casks but we do not recommend selling at 10 years old as your whisky is not yet a premium product and is still relatively common.

Older Whisky: Higher Risk

We do not suggest purchasing casks older than 12 years old for a personal investment. The prices are much harder to verify and you have increasingly high risks of overpaying or buying a sub-standard cask. In our experience, older casks are suitable for immediate bottling, industry professionals and institutional investments only.

Further reading: How Much Can You Make From A Whisky Cask Investment?

Four: Where To Buy A Cask Of Whisky?

As with almost everything in 2024, you have a choice of options of where to buy a cask of whisky. Each has advantages and disadvantages that you need to be aware of. We will touch upon these below, although please do use this as a starting point for research.

Direct From A Distillery

We have a blog that lists the distilleries where you can buy casks directly. Do be aware that we don’t endorse, or otherwise, buying direct from a distillery, but if you want a straightforward, quick purchase of new make whisky with clear ownership then it could be an option to consider.

Through A Broker

Mark Littler Ltd are a broker and we believe there are several advantages to buying through this model.

Primarily brokers tend to sell through a delivery order as the broker model means they don’t own stock but negotiate sales between buyers and sellers (like an estate agent). A delivery order means you have full ownership of your casks giving you security and flexibility. Because we don’t buy huge volumes of one type of stock we can also offer a wider selection of casks compared to a dealer or buying direct from a distillery.

Via A Dealer

Buying from a dealer can be another quick option as most have lists of current stock that they will send you. It is important to note that many dealers do not sell via a delivery order (we’ll go into delivery orders more in the following section). This means you need to make sure you understand the ownership structure they are offering and the limitations that are likely to have in terms of taking samples and when you come to sell.

At Auction

We suggest that buying a cask at auction is only for cask investors with a solid understanding of prices and ownership. You will need a private account at a warehouse in order to bid on casks. If that warehouse isn’t the one where the cask is currently stored you’ll be liable for the costs to get that cask transferred between warehouses under bond.

The above are very brief summaries of each option. Do look into your preferred seller further, and as always, we are happy to answer questions if you have any.

Five: How You Own A Cask?

In order to own a cask of whisky and have full control over it now and in the future the cask needs to be transferred into your name at the warehouse. Traditionally this is done via a delivery order and most warehouses will accept a delivery order as it satisfies their legal responsibility with HMRC.

You do not need a WOWGR to own a cask at the warehouse level, but you do need a warehouse that will open a private account.

We suggest following the guidance of the Scotch Whisky Association. This is sometimes misquoted by omitting the final paragraph, so for the avoidance of doubt you can read the full guidance via the download link at bottom of this SWA page.

“If the cask is located in a warehouse that belongs to someone other than the seller, you should ensure that the transfer of ownership is properly recorded and acknowledged by the warehouse keeper. Traditionally this was done by way of a delivery order, a document setting out the details of the cask to be transferred, signed by purchaser and seller and then delivered to the warehouse keeper. Nowadays an invoice or owner’s certificate may suffice. Before completing the purchase you should check with the warehouse keeper what documents they require and ensure that the seller can deliver them to you.”

Further reading: What Is A WOWGR And Who Needs One? and What Is A Delivery Order?

Six: Selling A Cask Of Whisky

An important consideration with tangible assets is how you sell them when the time comes.

We have helped hundreds of customers exit their cask investment, brokering the sale of millions of pounds worth of casks. For the vast majority of cask owners the most profitable way to exit is to sell a cask whole in bond. You can still take a few bottles out for personal use when selling this way, but there are multiple benefits compared to bottling.

The benefits of selling in bond are: no additional taxes and VAT to pay, capital gains tax exempt, and the process is relatively quick (although do note that this is relative, as nothing is particularly quick in the whisky industry and getting the best price can take a couple of months).

For comparison, if you want to bottle a cask and take a profit selling the bottles you will need to pay: VAT at 20% of the purchase price, Duty + VAT at £31.64 + 20% per litre of alcohol, dry goods (labels, glass, capsules etc) someone to bottle it for you, marketing cost… the list goes on but check our Cask Calculator for a more indepth look.

Usually it roughly doubles costs to bottle a cask, and then you need to pay either capital gains or income tax as well.

There are a handful of exceptions, but we would always address that with you at the time if we thought bottling would be the best option for your cask.

Another option people sometimes consider is auction or selling the cask back to the distillery. Generally we don’t suggest either of these as both tend to undervalue the cask reducing your potential profits.

Further reading: Selling A Cask Of Whisky

What Next When Buying A Cask?

This article is designed to be a whistle stop introduction covering how to buy a cask. If buying whisky casks sounds right for you then we would highly recommend exploring our online cask buying guides and downloading our free PDF using the form below.

If you’d like to find out more about buying casks with Mark Littler Ltd then please email [email protected].

Send me my free cask buying guide

"*" indicates required fields