A duty representative is someone authorised by HMRC to act as an agent for non-UK based businesses involved in the buying, selling and storage of duty suspended goods in UK excise warehouses.

The full details of duty representatives, warehousekeepers and registered owners and what they can and cannot do, are described in Statutory Notice 1999 No. 1278: The Warehousekeepers and Owners of Warehoused Goods Regulations 1999 or read on for a layman’s interpretation.

Do I need a duty representative to own a whisky cask?

For the purpose of owning whisky casks, you only need a duty representative if you are a non-UK based business.

- If you are a private individual in the UK then you are not classed as a revenue trader and therefore you do not need a duty representative. Furthermore Statutory Notice No.1278 states that a duty representative cannot represent you as an agent.

- If you are a private individual based outside of the UK then you are still not classed as a revenue trader and therefore it is our understanding that you do not need a duty representative.

- If you own a cask or casks through a UK based business you are classed as a revenue trader as per Excise Notice 196 and must apply to be a registered owner in order to store your casks in a registered excise warehouse (a registered owner is a revenue trader approved to deposit goods they own in an excise warehouse). In this instance a duty representative cannot act for you as per Statutory instrument No.1278.

Duty Representatives: parsing out the technicalities

As described in statutory instrument 1999 No. 1278 part III, a duty representative is a ‘revenue trader’ i.e. a registered UK based business or individual, who has obtained the relevant approvals to act as the agent for other revenue traders. (The Warehousekeepers and Owners of Warehoused Goods Regulations 1999 > UK Statutory Instruments 1999 No. 1278 Part III. 6.—(1) to (3))

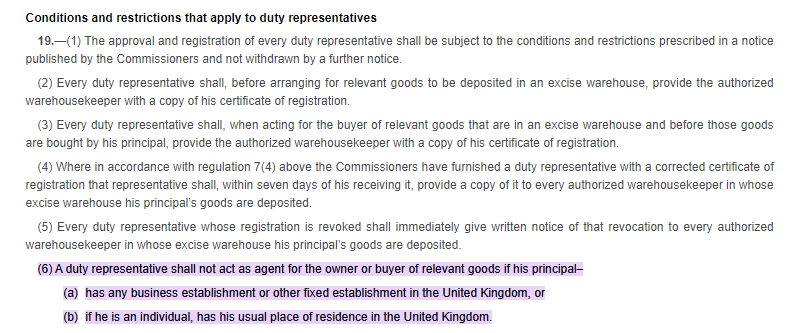

Statutory instrument 1999 No. 1278 part VII states that you cannot have a duty representative act as an agent for you if you have any business or fixed establishment in the UK, or your usual place of residence is in the UK. (The Warehousekeepers and Owners of Warehoused Goods Regulations 1999 > UK Statutory Instruments 1999 No. 1278 Part VII. 19.—(6))

Part VII also states that a warehousekeeper can keep goods in their warehouse that belong to either: a registered owner, someone with a duty representative, or anyone who is not a registered trader. (The Warehousekeepers and Owners of Warehoused Goods Regulations 1999 > UK Statutory Instruments 1999 No. 1278 Part VII. 17.—(2) to (3))

If you think you need to know more about duty representatives and whether you need one then please feel free to get in touch by emailing [email protected].