Whisky Cask Calculator

We have created our cask calculator to help you understand the costs involved in bottling a cask of whisky. We want you to be able to make an informed decision about buying and selling your cask of whisky so that you can buy quality whisky at a fair price.

Full guidance and an explanation for each section of the form are included below the calculator.

The full calculator will not work on a mobile device so please use a desktop for the most complete experience.

Whether you are looking at buying a cask and want some independent advice, or are looking into the options for selling your cask we are available to answer any additional questions, so please don’t hesitate to get in touch.

How Much Does It Cost To Bottle A Cask Of Whisky?

How to use the cask calculator

Original Purchase Price

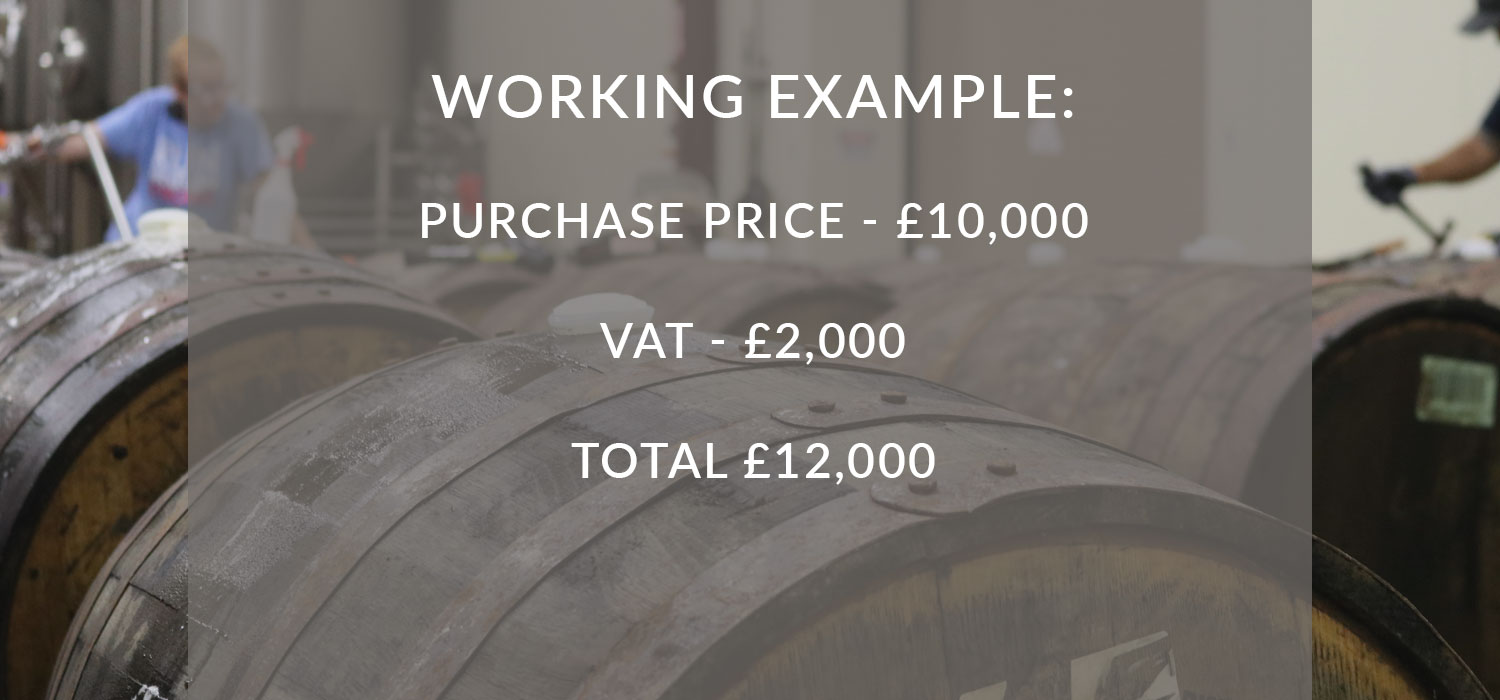

When you remove your cask from bond, VAT is payable at 20% on the original purchase price of the cask.

So, if you paid £2,000 for your cask you will owe HMRC £400 in VAT when the cask is removed from bond. Similarly, if you paid £20,000 you will owe £4,000 in VAT.

Use this section to enter the original price you paid to purchase your cask. Or if you haven’t brought your cask yet enter the price you are looking at paying.

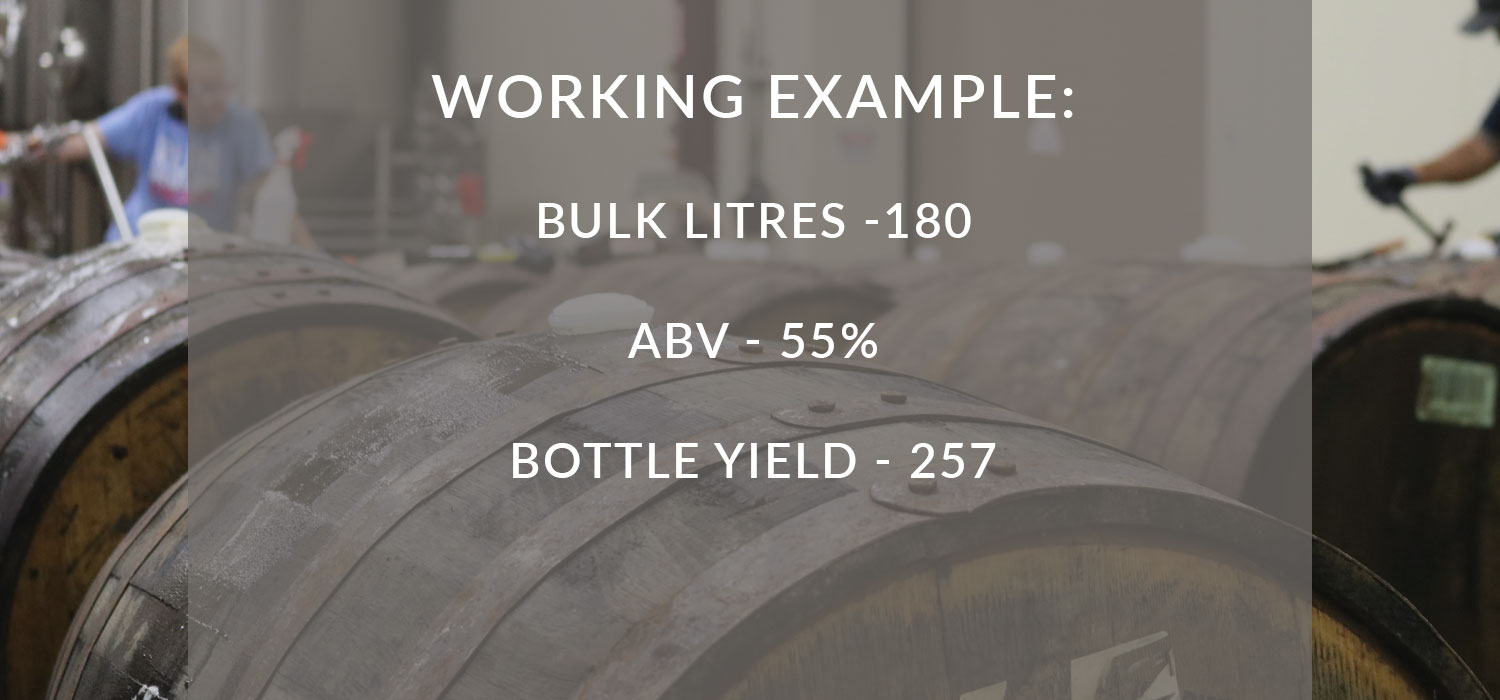

Cask Yield

Litres of pure alcohol is the industry standard to measure the yield of a cask. It is also what HMRC use to calculate the duty payable on a cask.

If you don’t know the bulk litres of your cask but you do know the RLA (regauged litres of alcohol) you can calculate the bulk litres using the following sum: RLA ÷ ABV % = bulk litres.

For example, if your RLA is 200 and your ABV is 50 your bulk litres will be 400 (200 ÷ 50%) .

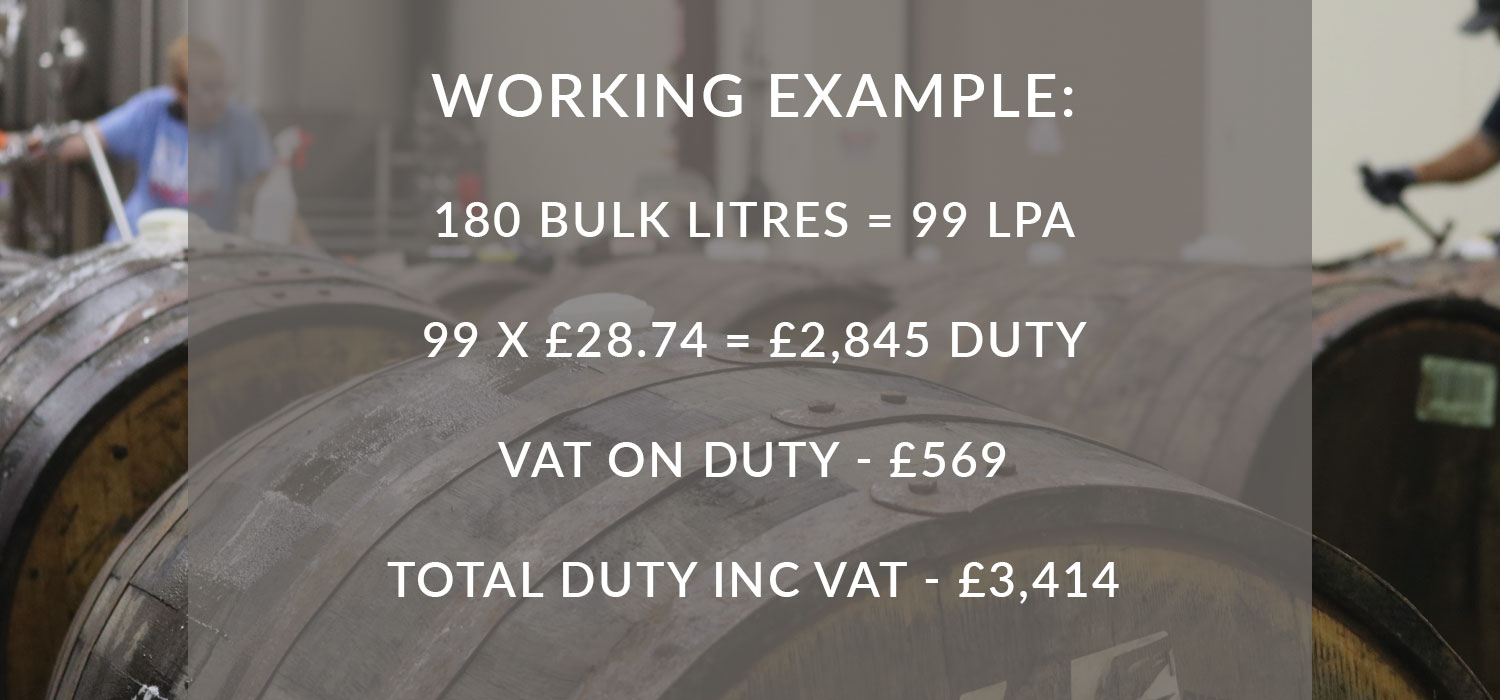

Duty

Duty + VAT is payable on each litre of pure alcohol in your cask as per HMRC Excise Notice 197.

The current rate is £28.74 per RLA + VAT.

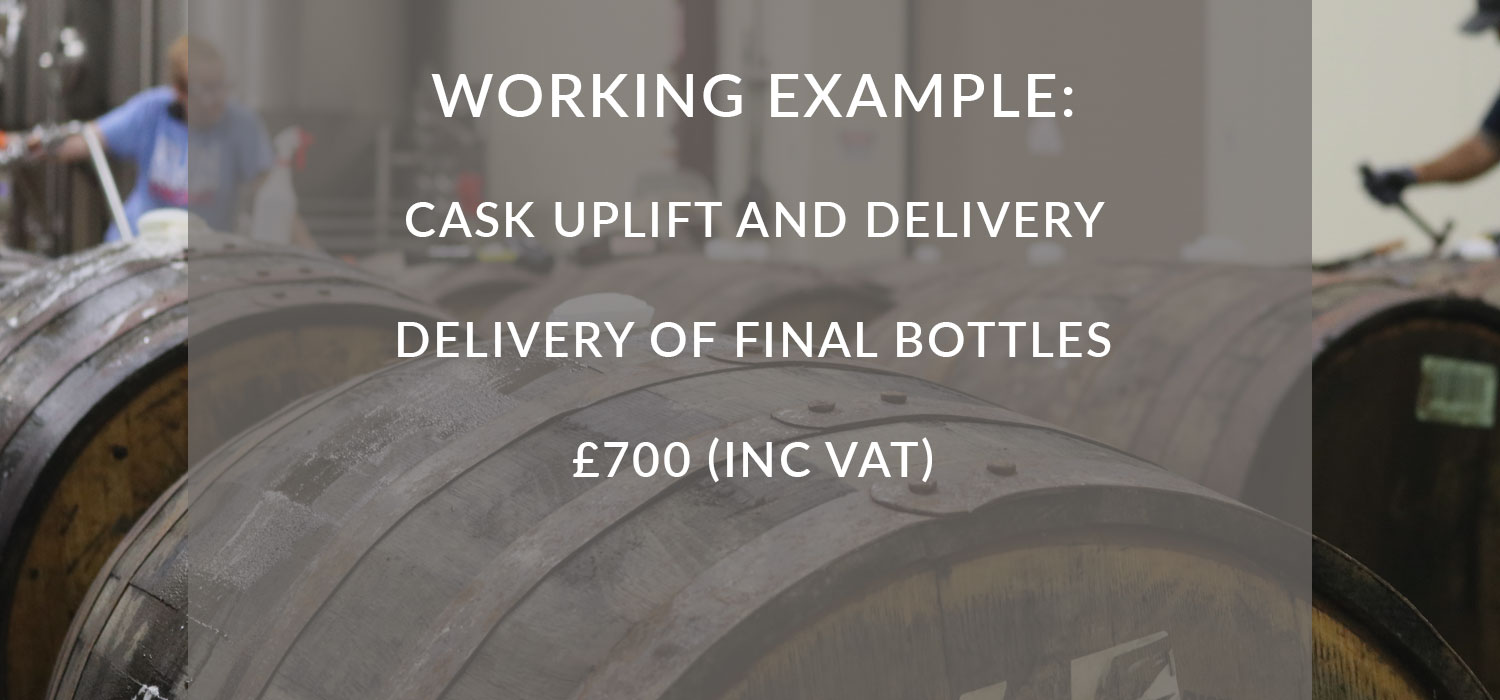

Uplift and Shipping

Your cask is stored in bond and usually remains in bond while it is transported. Because of this, and the unusual nature of transporting a cask, uplift and transportation of casks is done by specialist transporters. Shipping multiple casks is not usually significantly more expensive than shipping one.

For calculation purposes this figure also includes the cost of shipping the bottled stock from the bottler to you.

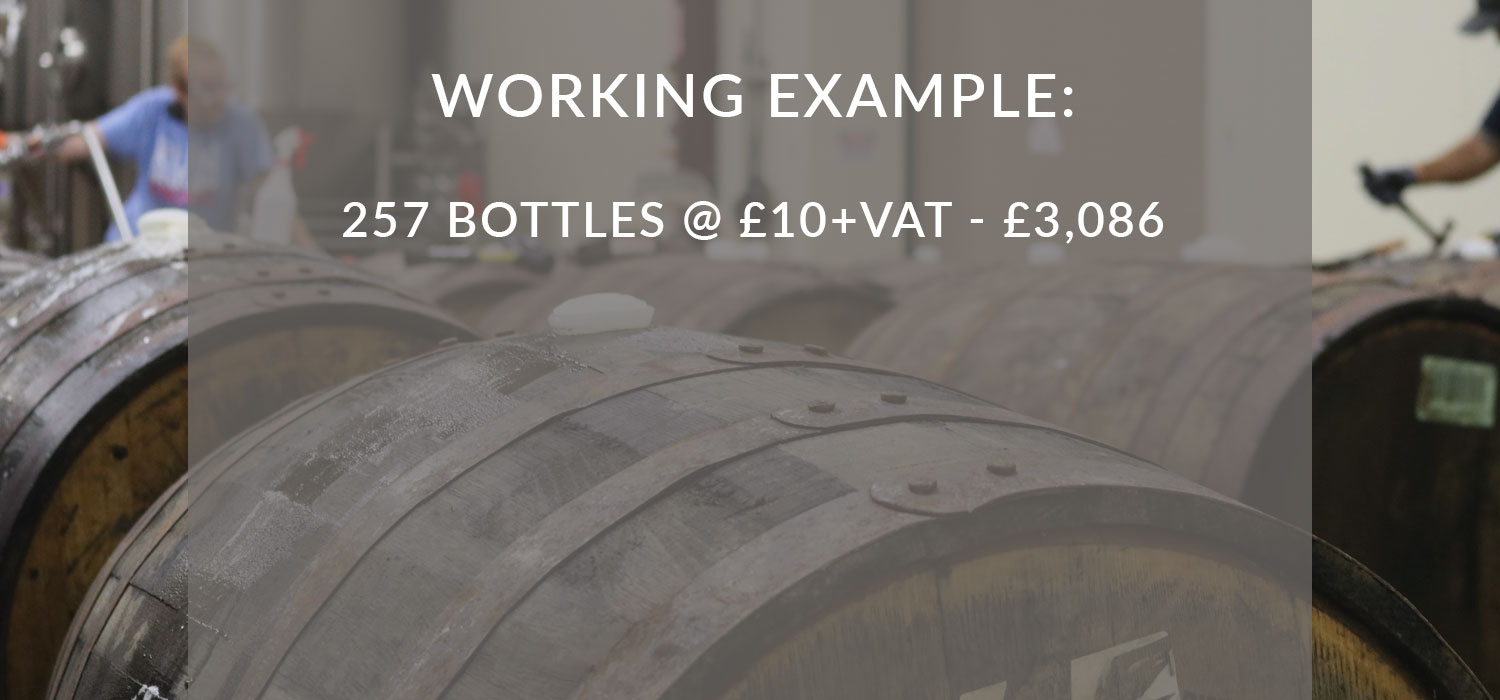

Bottling Fees

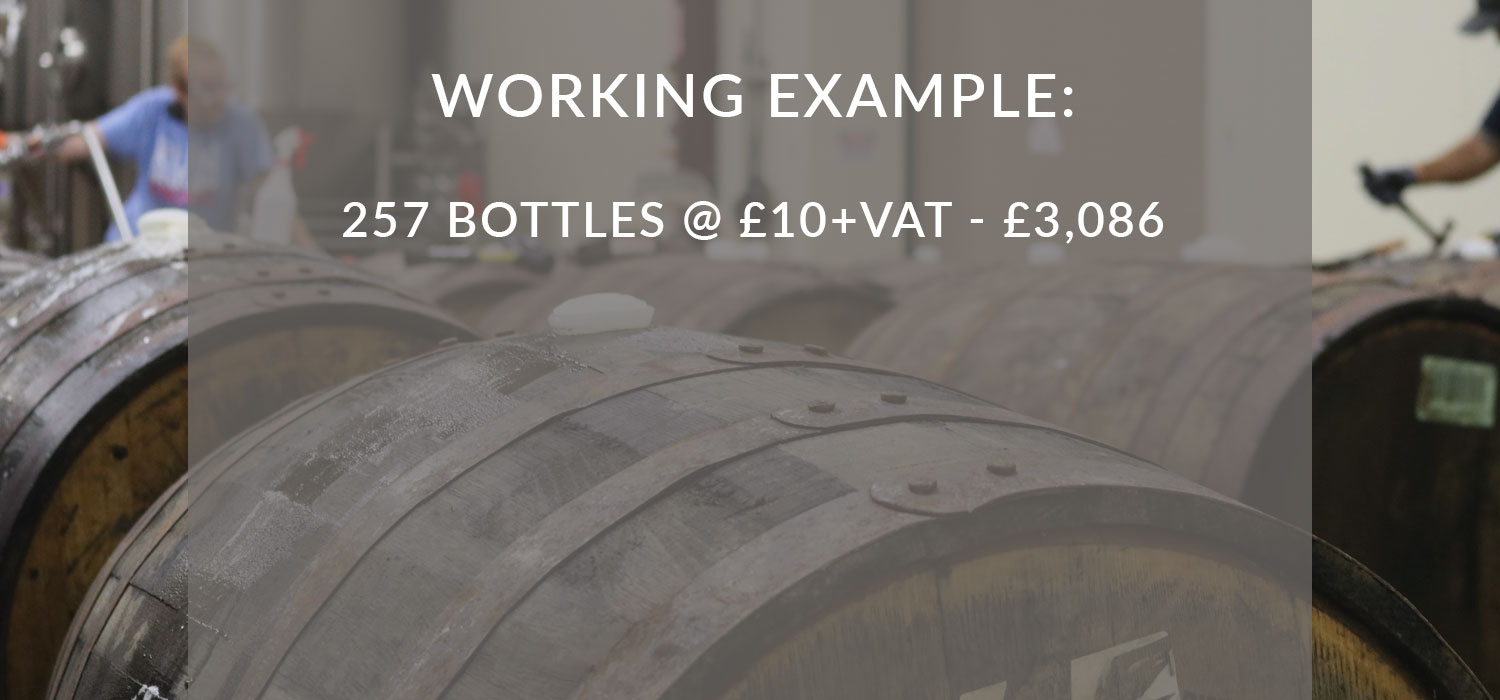

In our experience £10 + VAT per bottle is the approximate cost for good quality labels and bottles.

This produces an attractive final product and includes the cost of labels, bottles, corks, capsules and boxes.

You can do it for as little as £4 per unit + VAT, but they look cheap, which is not ideal if you are looking to sell a premium product.

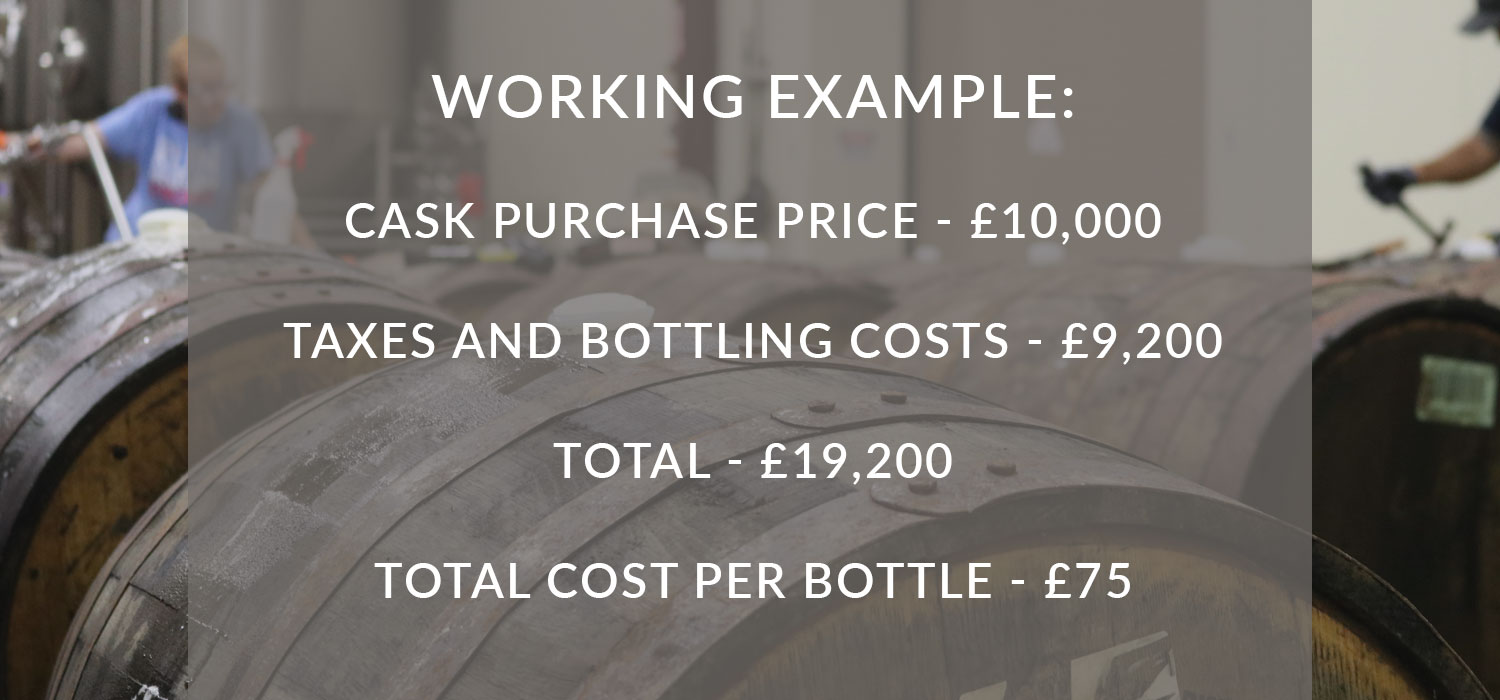

Final Calculations and Cost Per Bottle

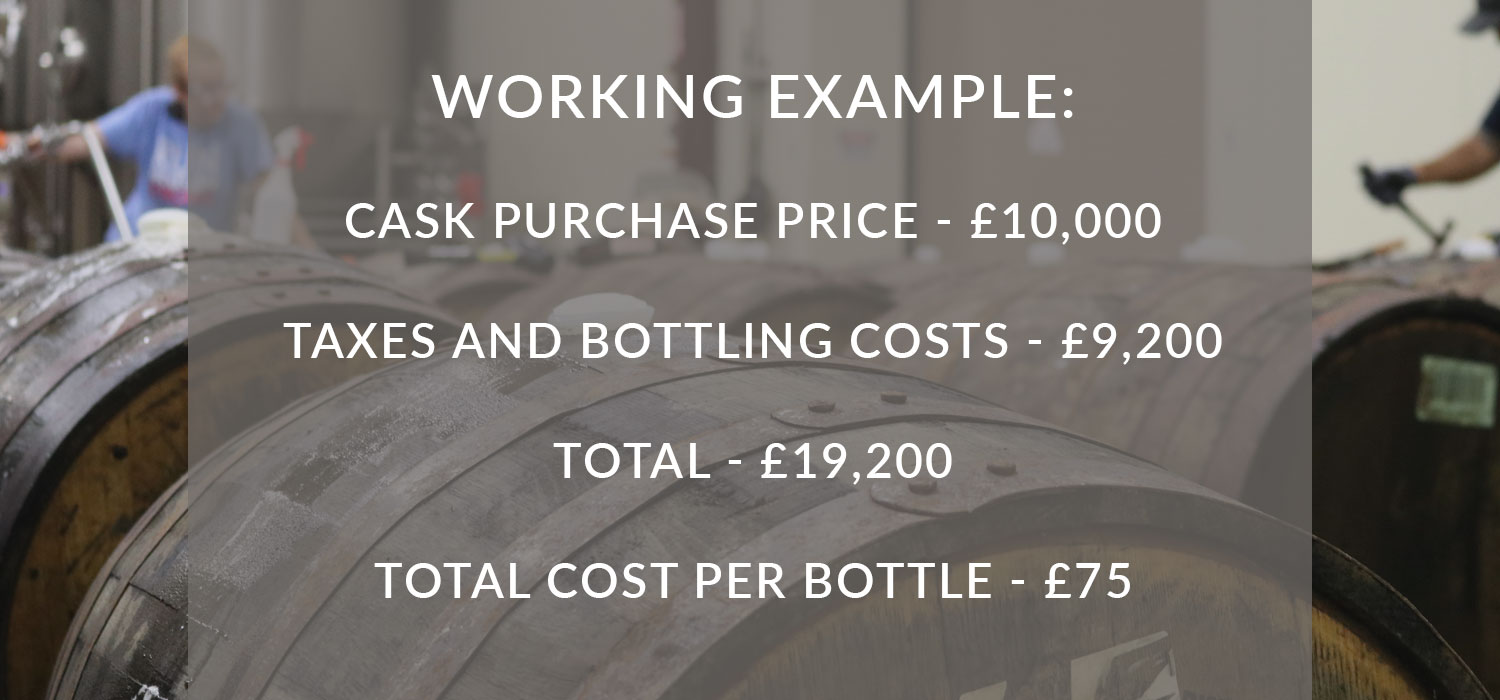

This shows your final costs and demonstrates the dramatic difference between your original purchase price and the final bottled price, which can often be more than double.

The price per bottle is the price you will have to charge per bottle in order to recoup your initial costs. This does not include any profit margin. Please see the Note on Margins & Additional Considerations sections for important points to know before you try and sell bottles of whisky.

Ouch!

From an initial purchase price of £10,000 the buyer may have predicted that their cost per bottle was only £39. However, the final bottled cost is almost double the purchase price. This brings the cost per bottle to £75.

Still, you might think there is a chance to profit. But as with everything that looks too good to be true there is more bad news…

Standard Whisky Industry Margins

The whisky industry works on a 50-60% mark-up from wholesale to retail. If you want proof of this here is an excerpt from an information pack provided by an investment arm of Diageo with relation to how to price products:

You’ll want to be at 60% gross margin, with a plan in place to get to a margin above 60%. We’d suggest not starting production if your gross margin is not at least 50%.

What this means is that the prices you see in retail stores (i.e. the prices in whisky shops) include are 50-60% more than what you can expect to achieve when you sell your bottles.

Additional Considerations

There are two final points which you need to take into consideration when you are looking at bottling your cask. The first is that you need several licences to sell alcohol in the UK:

- A personal licence

- A premise licence

- Membership of the Alcohol Wholesale Registration Scheme

Without these licences you are liable for a £20,000 fine and 6 months in prison as alcohol is a controlled substance.

The second thing you need to consider when you are thinking about bottling a cask, is that you most likely do not have a well-known brand to advertise and sell your bottles under.

This means that even for the highest quality casks, attractive bottles and successful application of the correct licences it can be difficult to sell your bottles to the public; as why would they choose to buy your un-proven bottle of whisky when they can go straight to the distillery and potentially buy something for the same, or less?

This means that for most private owners of casks the most cost effective way to exit is to sell the cask in bond. This is a simple and profitable way to exit a cask investment and if you have a cask that you are deciding how to sell, please do get in touch.

Send me my free cask buying guide

"*" indicates required fields

AS FEATURED IN

How Much Does It Cost To Bottle A Cask Of Whisky?

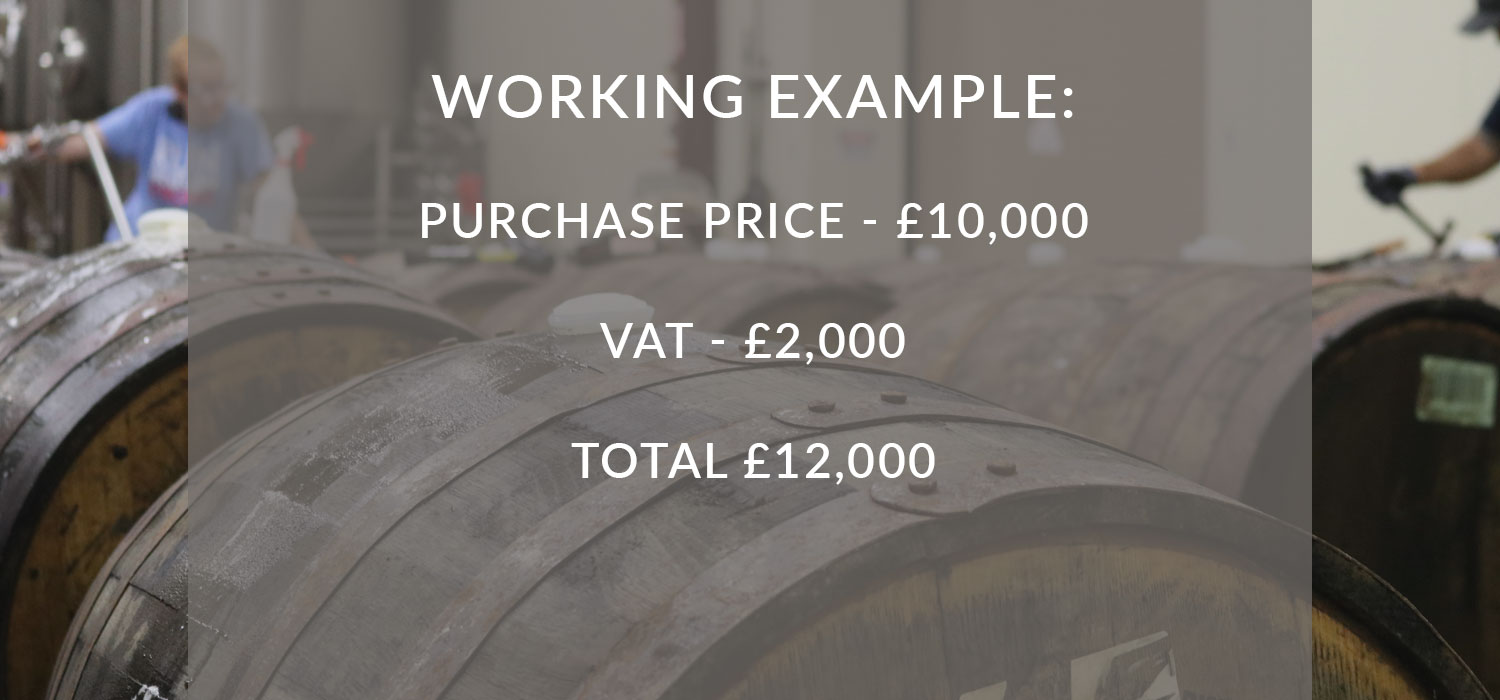

Please use a desktop computer to view the full calculator, however, we can run you through what you need to know alongside a working example:

Original Purchase Price

When you remove your cask from bond, VAT is payable at 20% on the original purchase price of the cask.

So, if you paid £2,000 for your cask you will owe HMRC £400 in VAT when the cask is removed from bond. Similarly, if you paid £20,000 you will owe £4,000 in VAT.

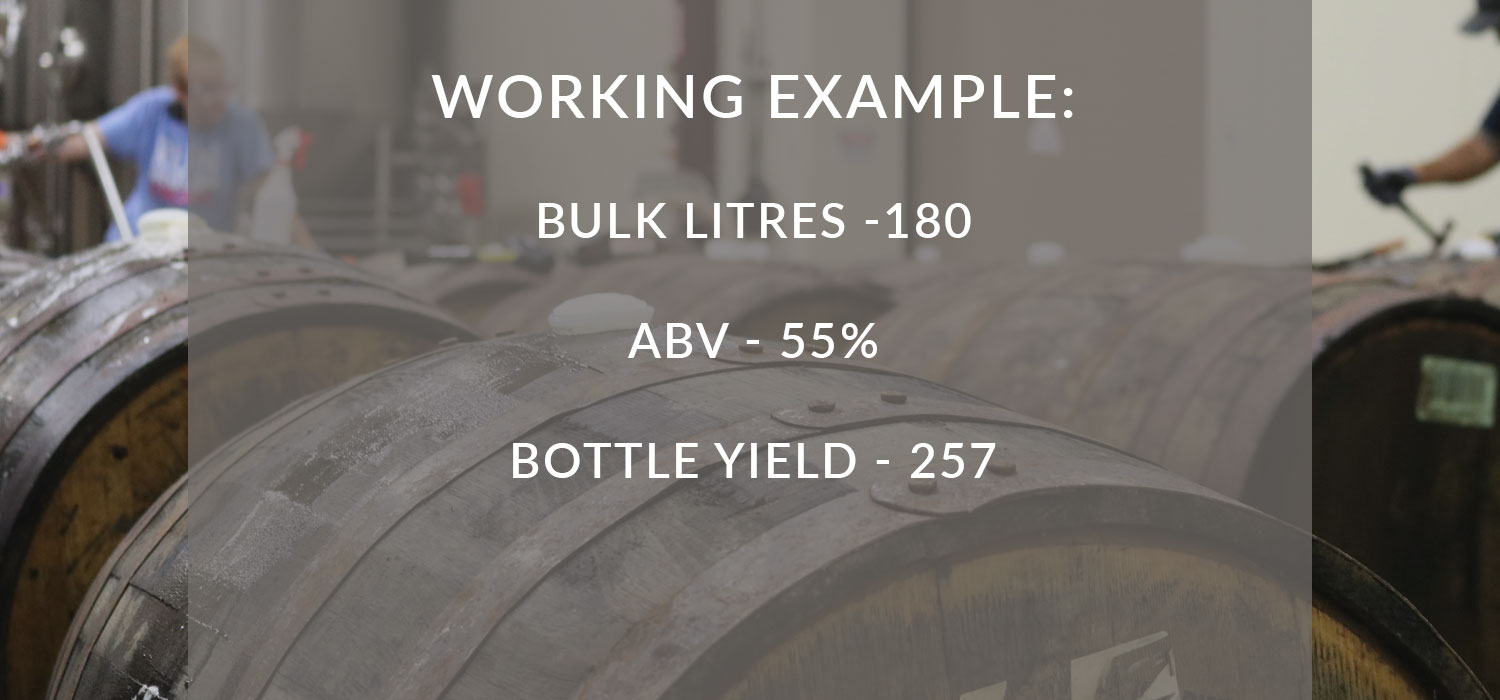

Cask Yield

Litres of pure alcohol (LPA) is the industry standard to measure the yield of a cask. It is also what HMRC use to calculate the duty payable on a cask.

If you don’t know the bulk litres of your cask but you do know the RLA (regauged litres of alcohol) you can calculate the bulk litres using the following sum: RLA ÷ ABV % = bulk litres.

For example, if your RLA is 200 and your ABV is 50 your bulk litres will be 400 (200 ÷ 50%) .

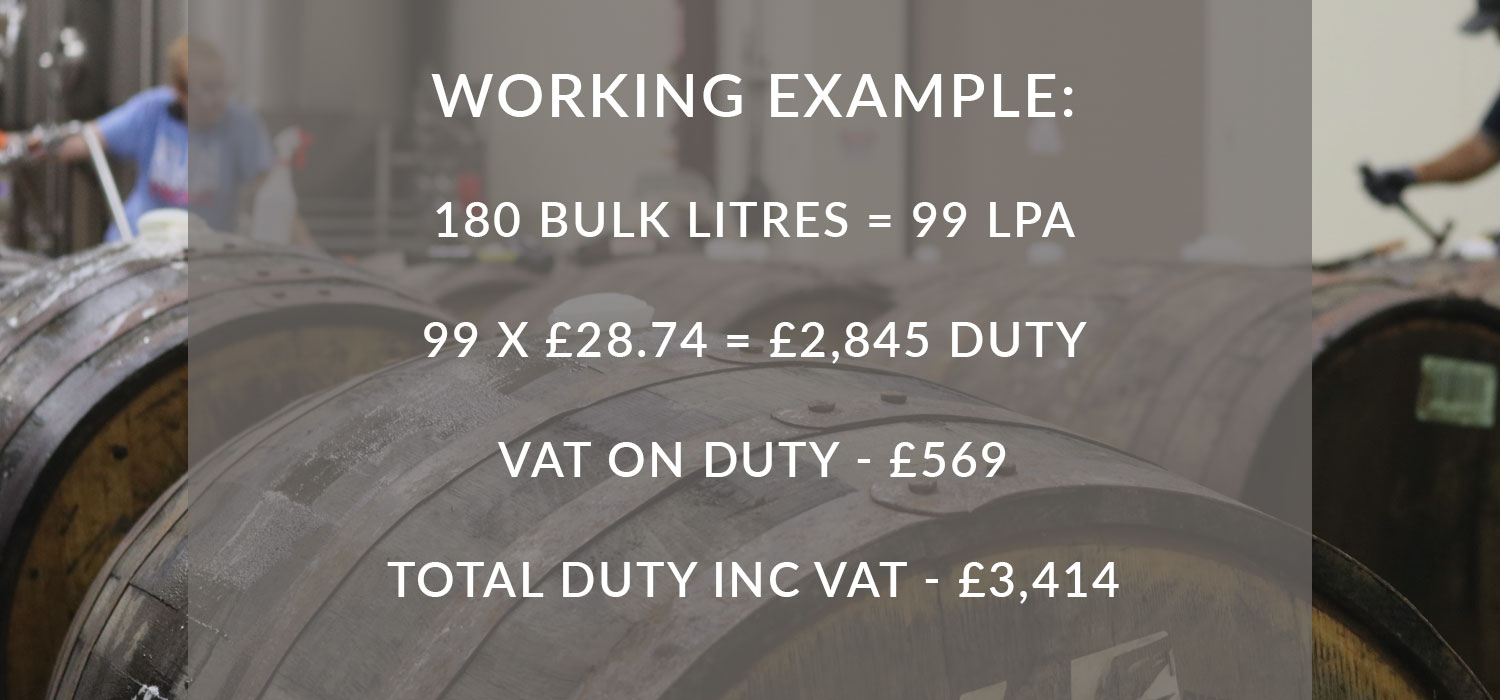

Duty

Duty + VAT is payable on each litre of pure alcohol in your cask as per HMRC Excise Notice 197.

The current rate is £31.64 per RLA + VAT.

It’s quite incredible that VAT is charged on top of Duty – it’s essentially tax on a tax.

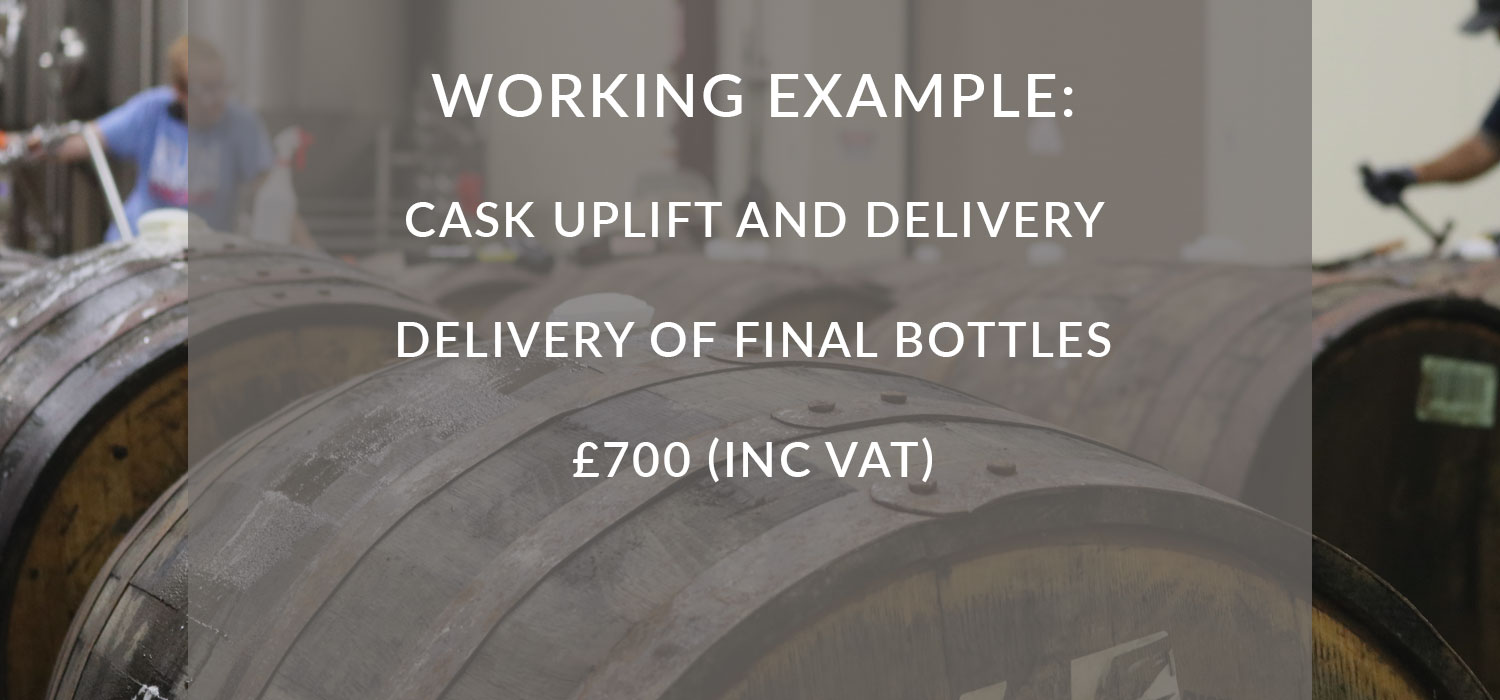

Uplift and Shipping

Your cask is stored in bond and usually remains in bond while it is transported. Because of this, and the unusual nature of transporting a cask, uplift and transportation of casks is done by specialist transporters. Shipping multiple casks is not usually significantly more expensive than shipping one.

For calculation purposes this figure also includes the cost of shipping the bottled stock from the bottler to you.

Bottling Fees

In our experience £10 + VAT per bottle is an approximate starting cost for quality labels and standard bottles.

This produces an attractive final product and includes the cost of labels, bottles, corks, capsules and boxes. Cheaper options are available, but will impact what you can eventually hope to sell your bottles for.

Final Calculations and Cost Per Bottle

This shows your final costs and demonstrates the dramatic difference between your original purchase price and the final bottled price, which can often be more than double.

The price per bottle is the price you will have to charge per bottle in order to recoup your initial costs. This does not include any profit margin. Please see the Note on Margins & Additional Considerations sections for important points to know before you try and sell bottles of whisky.

Ouch!

From an initial purchase price of £10,000 the buyer may have predicted that their cost per bottle was only £39. However, the final bottled cost is almost double the purchase price. This brings the cost per bottle to £75.

Still, you might think there is a chance to profit. But as with everything that looks too good to be true there is more bad news…

Standard Whisky Industry Margins

The whisky industry works on a 50-60% mark-up from wholesale to retail. If you want proof of this here is an excerpt from an information pack provided by an investment arm of Diageo with relation to how to price products:

“You’ll want to be at 60% gross margin, with a plan in place to get to a margin above 60%. We’d suggest not starting production if your gross margin is not at least 50%.”

What this means is that the prices you see in retail stores (i.e. the prices in whisky shops) include are 50-60% more than what you can expect to achieve when you sell your bottles.

Additional Considerations

There are two final points which you need to take into consideration when you are looking at bottling your cask. The first is that you need several licences to sell alcohol in the UK:

- A personal licence

- A premise licence

- Membership of the Alcohol Wholesale Registration Scheme

Without these licences you are liable for a £20,000 fine and 6 months in prison as alcohol is a controlled substance.

The second thing you need to consider when you are thinking about bottling a cask, is that you most likely do not have a well-known brand to advertise and sell your bottles under.

This means that even for the highest quality casks, attractive bottles and successful application of the correct licences it can be difficult to sell your bottles to the public; as why would they choose to buy your un-proven bottle of whisky when they can go straight to the distillery and potentially buy something for the same, or less?

This means that for most private owners of casks the most cost effective way to exit is to sell the cask in bond. This is a simple and profitable way to exit a cask investment and if you have a cask that you are deciding how to sell, please do get in touch.

Send me my free cask buying guide

"*" indicates required fields

AS FEATURED IN