We introduced the question ‘Are Whisky Casks A Good Investment?’ in an earlier blog post. That post introduced the principles of investment in casks that allow whisky to be a sound investment when done correctly. It covers:

- The basics of how whisky casks increase in value

- Why returns vary

- Whether casks are the right place for your money

If you haven’t read that article then it is worth a gander alongside our free cask buying guide and the information that we will cover in this article.

The 5 common pitfalls that stop casks from being a good investment:

- Paying too much for your cask

- Not checking clauses in your contract

- Neglecting your cask and allowing the ABV to drop below 40%

- Falling fowl of scams

- Not keeping your cask long enough

These are the top 5 pitfalls we have come across over the years working as a broker and helping our customers sell their casks of whisky. We will run through each in more detail below and explain how to check for and avoid each of them when you come to buy a cask.

2. Not checking the clauses in your contract

There are two ways that clauses in your contract can impact your cask investment. The first is through restrictive covenants, and the second is via dealers earmarking part of your future profit.

Restrictive covenants

Restrictive covenants are additional clauses that limit some aspect of how you use that cask in the future. The most common restrictive covenant in casks is not being able to use the distillery’s name on future bottlings (although this one is one that can be sidestepped sometimes).

Another is being restricted on what you can do with that cask once it is mature; for example if you’re lucky enough to be selected to buy one of the very limited casks of Macallan that are released by the distillery, you can only have it bottled for private consumption.

Profit share

It has come to our attention that some whisky cask dealers have clauses in their contract that entitle the dealer to 10-20% of your future profit when you come to sell the cask. As this has the potential to have a sizeable impact on your future return on investment this is a clause to keep an eye out for.

The take home from pitfall number two is to make sure you read your contact, and even more importantly, to make sure you understand it and the future implications to your ROI and ability to sell your cask.

Send me my free cask buying guide

3. Neglecting your cask’s health check

Whisky evaporates from casks because they are porous. That means the volume of liquid of your cask reduces each year (which so long as it is kept properly is good news as it makes it a wasting asset and exempt from capital gains), alcohol evaporates more easily than water, and therefore the ABV drops as well.

According to the Scotch Whisky Association, Scotch whisky must have an ABV of 40% or above to be classed as whisky. But just as importantly a high ABV commands a premium when you come to sell your cask. It is important to keep an eye on your cask’s ABV in order to make sure the content of your cask remains legally ‘whisky’ and that you come to sell it at the right time in order to make the most from your cask investment.

How do you monitor the content of your cask?

A regauge is standard industry practice for monitoring the content of a whisky cask. We run through the details in this video, but essentially a regauge will tell you the ABV and bulk litres in your cask, which you can then use to monitor your casks health.

When you come to sell your cask a good ABV can has as much influence on the value as the age. And it is better to sell your cask with a healthy ABV than waiting for arbitrary anniversary years and risk the ABV dropping below 40%. So a regular regauge can help monitor your cask’s health and help you choose the right time to sell it.

4. Falling for a whisky Scam

Whisky scams are not a new phenomenon and as well as learning from past mistakes you need to be vigilant when deciding where to buy your cask investment. Explore our whole article on some of the most infamous scams, or here are the key takeaways:

- Do your research thoroughly into the company’s history and that of its directors. Use Companies House (https://www.gov.uk/government/organisations/companies-house) and Google the names of the directors to see their previous enterprises and business history.

- Do not take reviews on face value. Make sure you click through any claimed reviews to ensure they are verified, relevant to the company’s services and spread across a long period of time.

- Verify any claims from multiple sources: if claims on returns or guarantees are given, check them and ensure they are explicit in your contract.

- Check your contract thoroughly and if something does not make sense ask to have it explained to you, or even better, have the contract independently checked.

- Do your own research on the distilleries whose casks are being offered. Ensure the distillery exists and get an idea for what bottles sell for at wholesale by checking whisky auction sites.

- If it looks/reads/sounds to good to be true it probably is. Remember businesses are there to make money and if their fees are not disclosed ask them why not and ask what proportion of the cask’s ‘price’ is their profit.

As cask sales are not regulated you need to be vigilant when looking into purchasing a cask.

5. Not keeping your cask long enough

The penultimate pitfall to be avoided is thinking that casks are suitable as a short-term investment.

Casks have three distinct periods of their life, which we refer to as:

- New Make: Specifically whisky that has been distilled in the current year, we also use it to describe maturing spirit that is not yet whisky, i.e. casks less than 3 years old.

- Young Whisky: Any cask that is in the ‘slow’ growth period of their maturation; generally 3-12 years.

- Mature Whisky: A cask generally older than 12 years.

The price of new make has been increasing in recent years and so we don’t generally sell casks under 3 years.

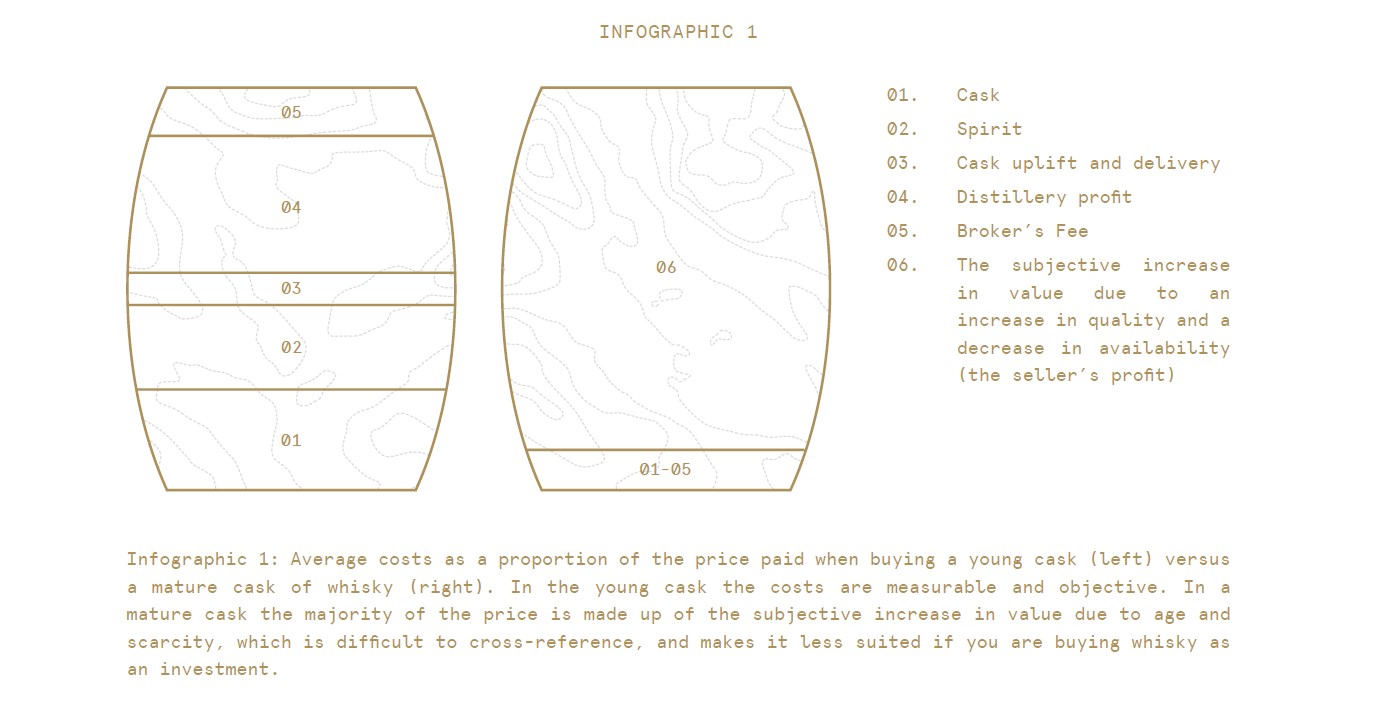

For young whisky the majority of the purchase price is made up of objective costs: the cost of the cask itself, the cost of the spirit that goes into the cask, admin costs of moving and registering your cask, the distillery’s profit and the brokerage fee (£300 a cask from us). This means the price you pay is easier to check and verify to ensure you are not paying over the odds for a cask, infographic 1.

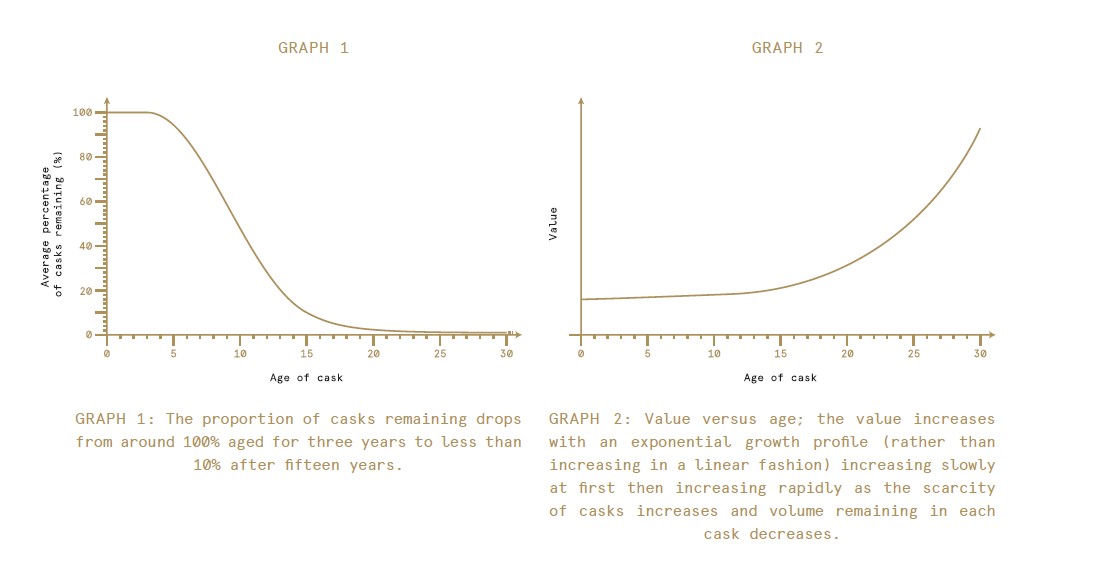

More than 90% of all casks are used before they are 12 years old, graph 1. By purchasing a young cask and keeping it as a long-term investment, scarcity and an increase in quality due to interactions with the wood make your cask of whisky more valuable as it ages.

When a cask is over 12 years old it generally enters the period of more rapid increase in value, graph 2. This has led to the proliferation of the belief that buying a mature cask over 12 years old makes casks suitable as a short-term investment.

If you can ensure that you are not overpaying for the cask and that you have the means to monitor your cask’s ABV regularly to ensure it doesn’t drop below 40% then you could do a shorter term investment. However, there is no jump in value at anniversary years and you are still probably looking at holding that cask for 5 years to see a ROI due to the way casks are valued. (Nothing moves quickly with casks and so an offer on a cask may take into account that cask not being used for 12 months and you won’t see any increase at all in the first 12 months.)

The ‘if’ on the previous paragraph is a very big if, because the making sure you are not overpaying for you mature cask pitfall is intertwined with this pitfall and is the situation we see most often with people who purchased older casks: Customers have come to use to sell a cask having purchased a mature cask after being told they can be a short term investment and that the value will jump when they hit 18… 20… insert arbitrary age here… years old. They have usually overpaid for the cask (often so much that it is still worth less than they paid for it even after they have waited the period they were told when they made the investment), and often the ABV is low so that the cask is not suitable for longer term storage in order to make anything like the returns they were promised.

While this is not a scam per say (the sale of casks are not regulated by anyone and the original seller is usually protected by their contract) this does go back to point f on the avoiding scams pitfall:

If it sounds too good to be true, it probably is.

The most reliable way we have experienced to make money from casks is as a long-term investment and so that is what we suggest.

6. The easiest person to fool is yourself

A bonus sixth pitfall for the dedicated few who made it to the end of this blog.

Casks can be a great investment. We have seen that repeatedly. But only when they are bought for the right price, at the right age, and kept as a long-term investment.

It is especially important to bear in mind that cask sales to private buyers are not regulated. And if there is one thing that our whisky scams blog drew our attention to, it is the surprisingly number of instigators of whisky scams who go unprosecuted and are able to carry on in the industry in another capacity or under a different trading name.

At Mark Littler we have spent a lot of time and energy creating content to educate the public about buying casks so that people like you can buy a quality cask at a fair price. Yes, we sell whisky casks and can sell you one, but honestly we would rather you didn’t buy a cask than you buy one when it is not right for you and your situation.

If you are not sure about something, or if you want a valuation or a second opinion, just ask. Whether you buy a cask with us or not, we want you to be the hardest person to fool.