Since Mark Littler started acting as a broker to sell whisky casks we have helped our customers sell their casks for anything from £5,000 to £147,000. All our customers bought their casks for an initial investment of £1,000 to £3,000. Whatever the returns seen by each customer they all had one thing in common. They all bought young whisky casks, let them mature for 10-15 years and sold them as mature whisky.

This strategy of buying young whisky and selling it as a mature casks is one that we have seen work and which fits in with the general functioning of the whisky industry. As such this if you want to buy a cask this is what we suggest.

For the sake of clarity, at Mark Littler Ltd we use three terms when talking about the age of whisky; new make, young casks and mature casks.

WHAT IS NEW MAKE?

New make can specifically refer to whisky that has been distilled in the current year however we also use it to describe maturing spirit that is not yet whisky, i.e. is less than 3 years old.

WHAT IS A YOUNG CASK?

We use the term ‘young casks’ to refer to any casks that are still in the slow growth period of their maturation; generally 3-12 years.

WHAT IS A MATURE CASK?

When we refer to ‘mature casks’ we are generally talking about casks older than 12 years. These are less suited to long term investment.

Why Buy Young Whisky Casks?

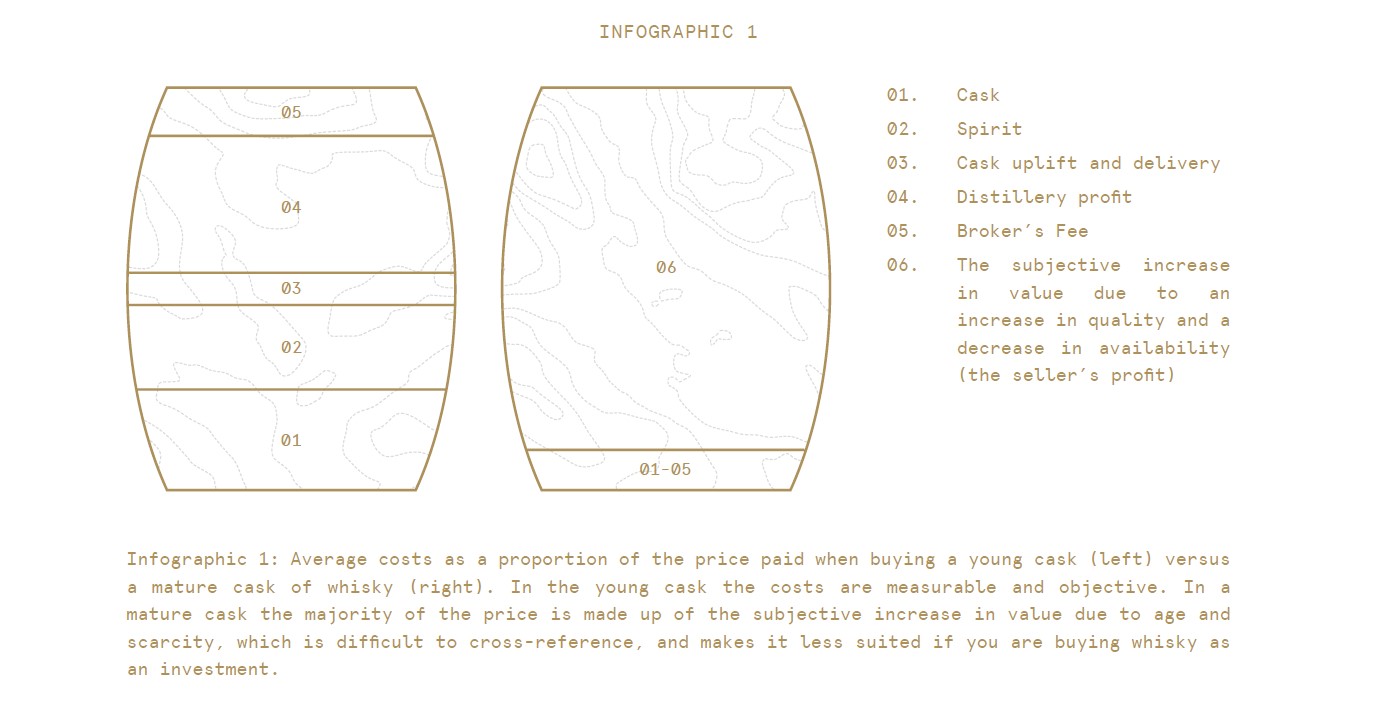

In young whisky the majority of the purchase price is made up of objective costs: the cost of the cask itself, the cost of the spirit that goes into the cask, admin costs of moving and registering your cask, the distillery’s profit and the brokerage fee (£300 a cask from us). This means the price you pay is easier to check and verify to ensure you are not paying over the odds for a cask.

The value of a cask has historically increased with age, due mostly to a perceived improvement in quality and a reduction in availability (as most casks are used when they are less than 12 years old). However, how these factors influence the value and price of a cask are completely subjective and difficult to verify because the whisky cask industry is still opaque. It is difficult for the public to find out how the reduction in volume due to the angel’s share affects the value, how much scarcity adds to value, and how tastes and fashions might change amongst other factors. These are all factors that can vary, and which can be used to manipulate the price of a cask so that you end up paying more than you should do for your investment.

At Mark Littler we have sold millions of pounds worth of casks for our customers, all of whom bought young casks. We helped them exit their investment for the best price and having seen exactly how it should be done, have decided to help our customers buy whisky. Our aim is to become a trusted source of information and we have created a comprehensive guide on investing in casks of whisky, so that you can buy quality whisky at a fair price.

We broker young whisky casks, that are generally under 12 years old.