Historically bottles of whisky have seen per annum returns that vary between 40% growth all the way down to negative 12%… Ultimately whisky is like any other investment; whether it is a good investment depends on which bottles you buy, and when.

To give you more of an in-depth understanding of how bottled whisky can be a good investment we outline a brief overview of the whisky bottle market, give a more detailed run through of what you can make, and finally what risks you should consider.

What is bottle investment?

At its very basic level investing in whisky bottles is the same as investing in anything else; you buy something that you believe is going to be worth more later because demand, scarcity, perceived value etc has gone up.

History of whisky bottle investment

For whisky bottles, secondary market values started to increase in the 1980s, with the earliest record value set in 1983 for a 50 year old Macallan, however the market was still very limited. It wasn’t until the 2010s after specialist online whisky auctions became more established that prices started to climb more steeply.

The market then saw its first peak in 2018/2019, which coincided with the first plus million pound sale and current world record prices being set. Up to that point we had seen pretty consistent growth across collectable bottles. Since then the market has been a little more variable, probably as a result of the combined impacts of the global COVID-19 pandemic, and the economic effects of that, and more recently of the Ukraine War.

What that means is you have two distinctive eras, if you purchased a collectable bottle pre 2010 you have almost certainly made money. The 10 year performance of the whisky bottle market has been unbeatable, but the important thing to remember here is that those figures are mostly only relevant for early adopters.

Just as significantly, not all bottles have performed equally. Above we specified collectable bottles, this is because just being from the 1980s (or earlier) alone is not enough to guarantee an increase in value, some 1980s whiskies are still worth less than £100, whereas some are worth thousands. Understanding this split, as well as the myriad of other facets impacting value, can help you work out what to invest in.

For more recent investors who have purchased in the last 5 years or are looking to join now, then you need a bit more care and understanding to navigate the market. Some bottles are still rising in value, but others have started to drop or plateau. Understanding the different sections of the market, and the underlying drivers of value can help you choose which bottles to invest in, and ultimately decides whether or not bottled whisky is going to be a good investment for you.

What can you make from bottled whisky?

There is a lot of data available on the historic prices of whisky bottles, that means it is possible to track current and historic trends in value, which allows you to work out what bottle investment has made in the past, and might make in the future. Of course, it is important to remember that past performance is not always an indicator of future performance. The market was very different even 5 years ago and therefore trends need to be interpreted with care.

A quick internet search will initially provide you with not much to go on, but with a bit of digging there are databases that provide some historic data and analysis. There is also the Knight Frank Luxury Investment Index provided in their annual Wealth Report and the various indices provided by Rare Whisky 101 as well as platforms like Whisky Stats, Whisky Hunter, Spirits Invest and others.

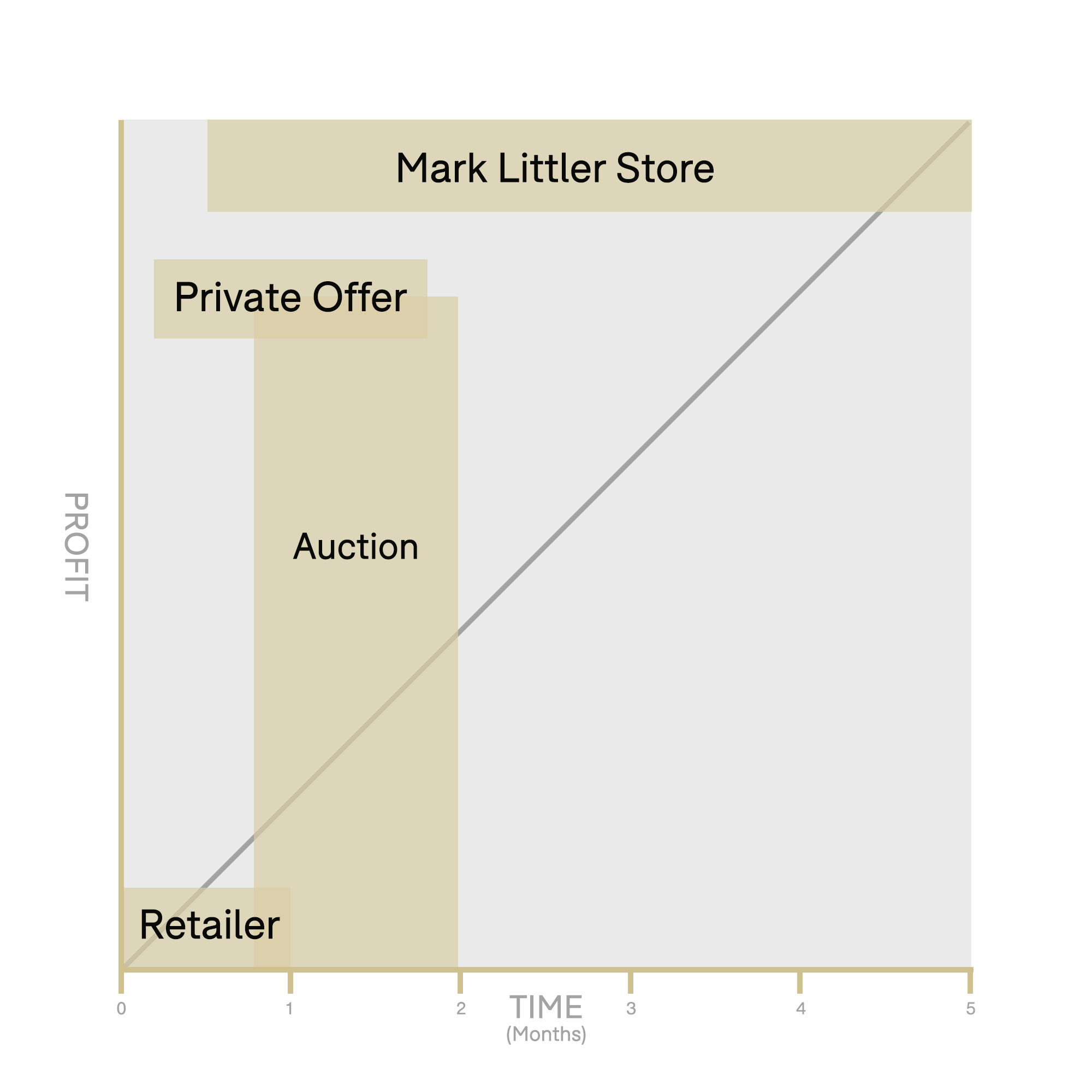

What sources will tell you is that you can make anything from 3.5% to 40% per year on a bottle investment. Less talked about are the potential per annum losses and the variation within the market.

We say not regularly, as it was touched upon in the 2021 Knight Frank Wealth Report, when they report a -4% drop in their Rare Whisky Index. They discuss variation in the market in the context of proving whisky bottles are still a good investment; by dissecting the index they show that one part has dropped 12%, and removing those bottles would provide a positive overall result. They also compare the KFRWI to other more general indexes to imply that the drop is isolated. While this is relevant context it is included in a way to make people think bottles are good investments, rather than as a way to educate bottle investors as to the risks.

What are the risks of bottle investment?

Like any investment, the biggest risk is the potential to lose money. Whisky bottles are a demand driven market, and like any investment the value can go down as well as up. You can reduce that risk by buying carefully, but you cannot remove it.

Ultimately you also need to remember that bottled whisky investment is an unregulated market and as a buyer you have no protection from bodies such as the FCA.

How can you lose money on bottled whisky?

- Bottles with no demand

- Buying at the wrong time (buying at the peak of the market)

- Bottles with the wrong brand

- Not understanding the different sections of the market

Demand and value

Demand is a really important consideration when buying whisky. A good example is Bells Whisky Decanters, which at one point sold for as much as £1,200 but now sell for £30 – if you can find someone to sell them for you. The market and tastes changed over the years, the demand for blended whisky dropped, and that also coincided with a tightening of sales of alcohol online. Which meant that items that were once the height of collecting fashion are now almost worthless.

Timing and value

Another more recent example of both changing demand and the importance of timing is the Macallan Genesis. Demand was very high when initially released in 2018 and secondary market prices peaked at just over £4,000, however the average price dropped steadily for the next 2 years. In 2020 the average price began to recover, although it started to plateau in 2022 and in 2023 the average value is still 40% lower than in 2018 (£2,500 – £3,000). If you purchased the Macallan Genesis at original retail you will have made money regardless of when you sold, albeit at different rates of return. If you purchased on the secondary market at the 2018 peak value you would have lost money, and but if you purchased in the 2020 low then values are still up.

The Macallan Genesis example highlights several considerations when looking at the potential for bottle investments; the importance of buying at the right time, the balance of brand and also the difference between modern versus vintage bottles.

Brand and value

Brand is going to be your most reliable driver of value. Brands like Macallan, Bowmore, Springbank and Dalmore are your Rolex, or Hermés of the whisky world; they are the top tier aspirational brands that people want to own, and which carry status.

Looking for the next big brand is one way to see bigger long term returns, but comes with its own risks. Sticking with known brands can give reliability and reduce risk. However it is not always a direct correlation between brand and value.

Circling back to the Macallan Genesis example shows how brand alone is not always reliable. Macallan is the collectors’ and investors’ brand of choice right now, however the Genesis bottle shows that just being The Macallan is not always enough. What’s more, bottles such as Macallan Private Eye show other stand-alone, NAS bottles can maintain healthy long term growth, so it is not that aspect that has impacted the Genesis performance. Which brings us to the split in the market between modern and vintage bottles.

Modern versus vintage bottles

There is a divide in the market for performance and risk between vintage and modern releases. Investment into vintage collectable bottles can be data driven and while that is not a complete hedge against future drops it does remove a lot more risk.

Modern bottles on the other hand, do not have the historic data behind them to indicate future performance. What’s more, the limited data that is available from other modern bottles show that they are much more volatile – see the Genesis example and also the Folios, which while impressive are very variable.

‘Flipping’ modern bottles that you get at retail is one way to invest in whisky, but ultimately it has much more risk associated with it compared to other bottle investment tactics.

Summary

Bottled whisky can be a good investment, it is one that both private individuals, funds and businesses are now considering more frequently as a way to diversify their investment portfolio. What we hope this article outlines is firstly that it is not without risk and that it is not as straightforward as buying any bottle of whisky and seeing an increase over time.

As part of our drive toward education around whisky investment we have created a comprehensive pdf that is free to download. We also offer professional advice for private and small office funds and can help you manage your whisky investment portfolio. Please get in touch if you would like to discuss this with us.