Just like any other investment you might be looking into, there is no one size fits all approach to how to invest in bottles of whisky. Your bottle purchase strategy is going to depend on what you are looking to achieve, your preferred length of investment and initial capital.

This is a big topic to break down into a single blog, but to keep things simple, there are six stages you are going to need to go through to invest in bottles of whisky:

- Educate yourself about the current and historical market

- Find some data sources

- Make some decisions:

- a. What’s your budget and investment time frame?

- b. What do you want to buy?

- c. Where are you going to buy?

- d. Where are you going to store it?

- Buy your bottles

- Wait

- Sell your bottles

We will run through each of these stages adding links to relevant sources that we think are useful. If you are after a more in depth guide to this then we also have an 80 page bottle investment guide that you can download for free. If you would like help building a portfolio for bottle investment please reach out to start a chat about what we can do for you.

How to start a whisky bottle investment?

Without intending to be patronising, you really need to start with educating yourself about the market you’re looking to get into. You probably wouldn’t walk into a car showroom without a basic understanding of what you were looking for, or buy a house without researching local house prices, and it’s the same with bottles, you are going to want to do a bit of research on the bottle market.

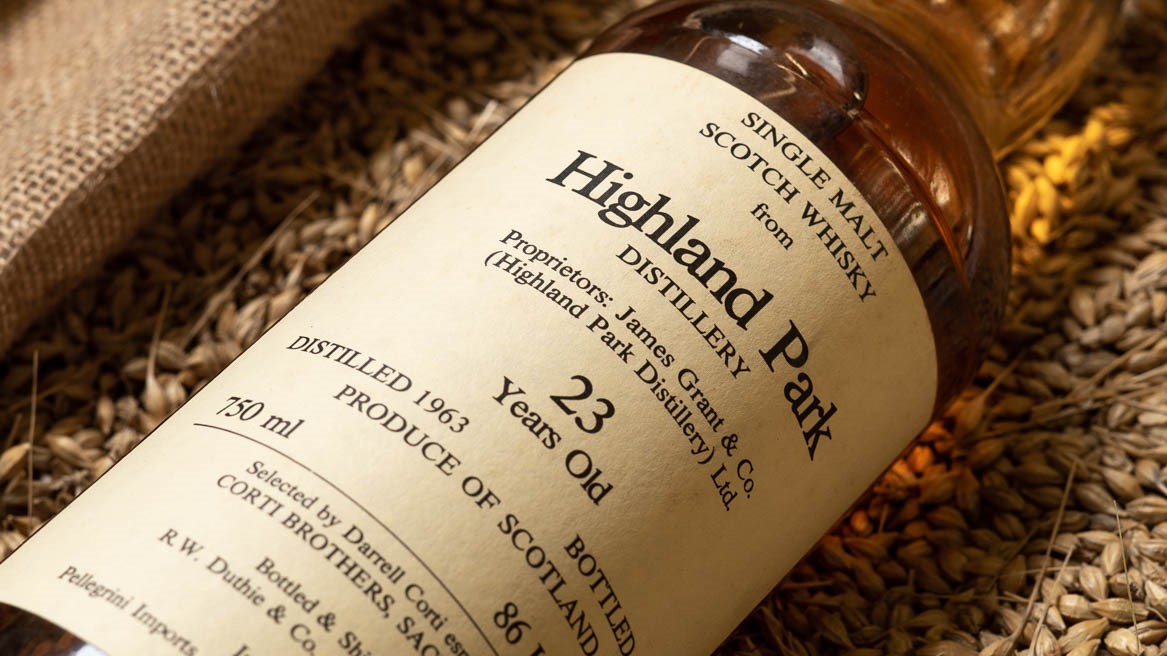

The reason for this is that there is a big difference in how different parts of the market work. For example, vintage bottles and modern releases can work in different ways. If you’re after a quick gamble modern bottles might be the route for you. If you’re after a data driven approach backed with historic results then it’s likely that vintage bottles are going to be more suitable.

Another example of the importance of understanding the market would looking at the Knight Frank Index in reference to whisky bottles. The Knight Frank whisky bottle index looks specifically at 100 of the rarest and most expensive whiskies on the market, and while that is an interesting reference it is of limited usefulness if you are investing in £500 – £5,000 bottles. Understanding what’s going on in the market and how different areas are performing can help you shape your investment and make the decisions in step 3. It can also help you understand when someone is trying to use misleading data.

Further reading:

The Power of Branding on Whisky

Finding data for your whisky investment

Once you have a solid understanding of the market the next step is to look at data. We’re not saying you need to be a data analyst, but it is a good idea to familiarise yourself with how to find values and how to look at how the market is performing as this can help you decide when to buy and when to sell.

Data on values is available for free by searching online auction sites, see the table below for a list. This is a good place to start to get an idea of the range of values across the market from bottles worth £20 up to £1.5million. When you search auction sites you’re also going to get pictures, so if you come across two of the same bottle with different values you can quickly get a handle on what might be driving that – usually a combination of the level of the whisky in the neck, the general condition and whether there is a box.

You may also notice that there can be variation in prices achieved by different auction houses for the same bottle. When you get to stage 3.c this can help you decide where to buy.

Some Whisky Auction Houses

|

Online only |

Online and Physical |

|

Whisky Auctioneer |

Sotheby’s |

|

Scotch Whisky Auctions |

Bonhams |

|

Whisky-Online Auctions |

McTear’s Whisky Auctions |

|

Just Whisky Auctions |

|

|

Whisky.Auctions |

|

|

Whisky Hammer |

Please note that the above isn’t an exhaustive list, nor an endorsement for anywhere in particular.

Once you are accustomed to the auction results you can start looking at other sources, things like Whisky Base can be useful.

Ultimately the best data sources are paid and if you want to search across multiple auctions, or see results over time, then you are going to have to pay for access to a database. Below we’ve added a table with some of the sources we have used.

|

Company |

Website |

|

Whisky Hunter |

|

|

Spirits Invest |

|

|

Whiskystats |

Again, please note that the above isn’t an exhaustive list, or an endorsement. If you know of any sites that we may have missed please let us know and we will review and add it if suitable.

How to decide what to invest in?

Now you understand the market and have an idea of what everything is worth, it’s time to make the decisions about your specific investment.

How much for how long?

First of all you want to set your budget and give yourself a guide for your investment window as this will shape what bottles you decide to go for. When you look at the data you found previously that will help you decide what’s best for you over the timeframe you are working toward.

What to focus on?

If you have a high budget you are likely going to be looking at different bottles compared to if you have a low to mid budget, and a lower budget might suggest you look at longer time frames and more speculative options to give yourself more potential returns. But if you’re risk averse it might be worth pooling a £500 per year budget and getting one high value bottle that has a solid history of growth.

What’s more, are you going to buy individual bottles that interest you, or do you want a more structured collection with a theme that may add value when you come to sell?

These are all things you need to decide based on your situation, which is why it is so important to know your market first.

Where to spend your money?

Once you have decided what to buy you need to decide when to buy it. We touched upon this in the previous section, when we discussed different auctions achieving different average prices for the same bottle.

In a wider context you also need to decide if you are buying at auction or retail. Retail is generally more expensive, but it does give you the option to start faster, and if you have built the additional cost into your price and timeframe then it can still be a fine place to purchase.

Where to keep your bottles?

Finally you need to decide where you want to store the bottles when you have bought them. You can store bottles at home but once your collection gets to a certain capacity you need to check it is covered on your home insurance.

Another option is a professional storage facility. This might be suitable for particularly high value bottles or if you have a large collection that is difficult to store at home.

You can also look at using a suitable self storage facility although you need to check this would be covered under your insurance.

You can get specialist insurance that will cover your collection across multiple storage options.

Buy your bottles!

This is it. Finally you have done your research and planning and now it’s time to go out and hunt those bottles down. Whether at auction or retail it is now just a matter of time while you build your collection.

Wait…

The slightly less glamorous side of investment is the waiting part. But once you have built your collection it is time to enjoy your bottles and keep an eye on the data sources. This will help you ensure your assets are increasing as expected, and if not allow you to adjust your plan accordingly. That can be to take advantage of market spikes if that would be part of your plan or to adapt your plan if you can see potential in new areas or brands.

Sell

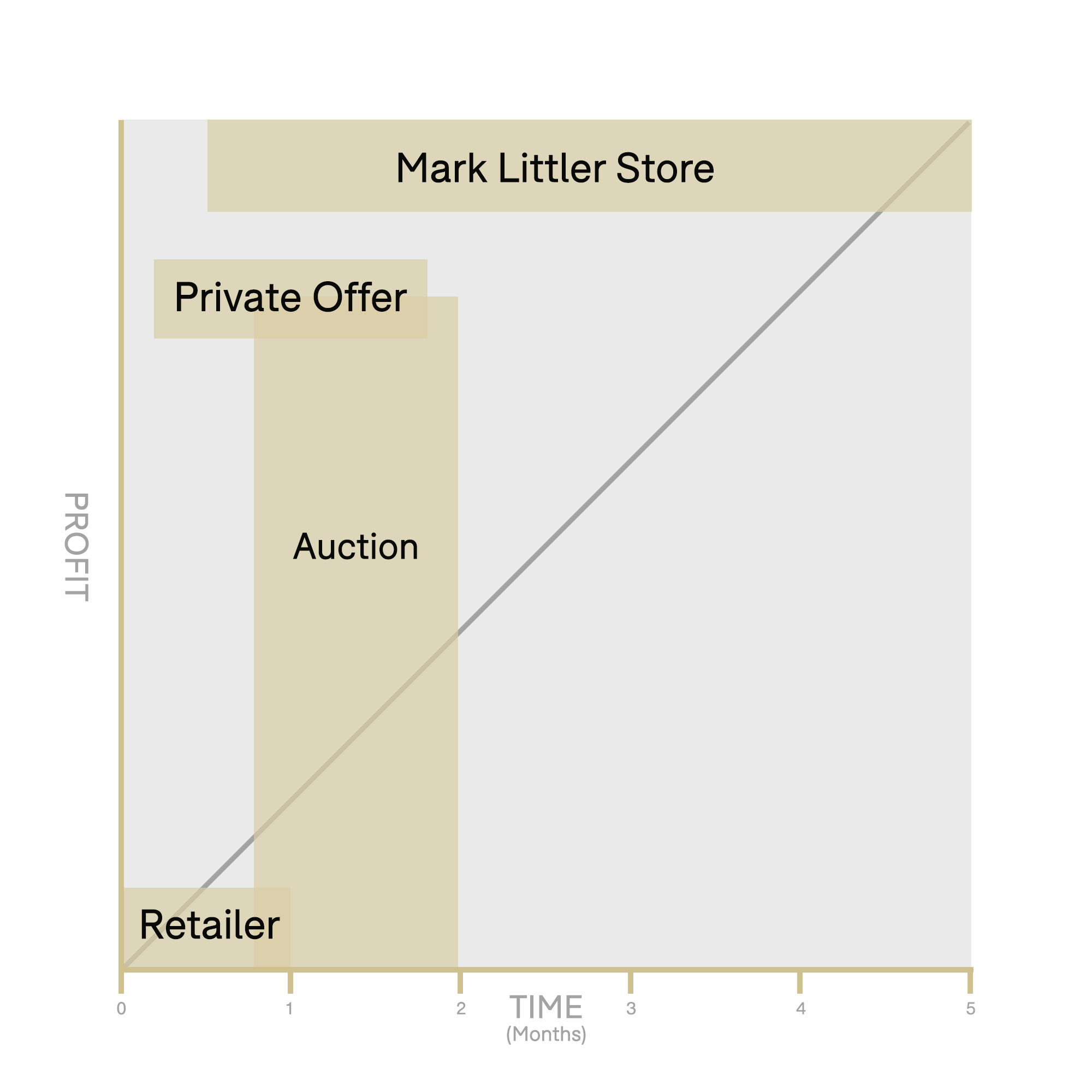

When you get to the point of selling your investment you will likely have a much more comprehensive understanding of the market that will help you decide how to sell. The route for exiting really depends on the collection as different methods will suit different collections.

You can sell directly through auctions, or alternatively using an independent broker such as ourselves can give you tailor made advice. At Mark Littler for example we are not tied to one route of selling, which means we can provide you with advice on how to make the most when you come to exit. We can act on your behalf working across multiple auction houses, private sellers and our shop to advise you on the most profitable course of action.

That is the whistle stop introduction to investing in whisky bottles, if you want a more comprehensive run through then please download out free bottle buying guide. The bottle buying guide goes through everything in more detail and includes things like the history of the market and information on indexes.

You can also buy and sell your whisky with us. From bespoke reports to building portfolios, we offer investment services tailor-made for you. If you would like help building a portfolio for bottle investment please reach out to start a chat about what we can do for you. If you have a smaller budget then Mark also offers ad hoc investment advice on his YouTube channel.

If you have already started your bottle collection and are looking for the most profitable way to exit your investment then we can also help you sell your single malt. From one bottle to 500 bottle collections we offer bespoke advice to help you get the best price for your collection, and can help you sell privately, via auction or through our online shop.

Email [email protected] for more information.