A cask of whisky could set you back anything from £2,300 to £16 million depending on what you are after and what your intentions are with the purchase. So how do you know how much you should be paying for a cask?

A few distilleries sell casks of whisky directly to the public, and a new make cask from one of those costs between £2,300 to £12,000 for a 200 litre barrel.

If you choose to buy a cask with Mark Littler LTD we suggest between £4,000 – £8,000 will get you a cask aged 3 – 10 years old from an established distillery suitable for a long term investment.

The £16 million mentioned above was achieved by a cask of Ardbeg in 2022, and that price included bottling and taxes to import the bottles to the new owner in Asia. It’s likely that cask wasn’t purchased as an investment, but as a luxury to enjoy.

Regardless there is still a significant range in the value of casks. That is because there are so many different factors that go into pricing up a cask of whisky, from what distillery it is from to what size the cask is.

Asking how much a cask of whisky costs is as vague as asking how much a house costs; before you can give a value you need to know a lot more details. For casks you need to know what’s in the cask, where its from and how old it is, amongst other specific details. Then you need to consider what you are purchasing it for.

The prices mentioned above are specifically for members of the public looking to buy a cask of whisky (as independent bottlers and blenders buy in bulk at wholesale prices).

How is the cost of a new cask calculated?

Over 400million litres of alcohol can be produced by distilleries in Scotland each year. That is 630million litres at an average of 63.5%, which equates to around 1.26million butts or 2.5million Hogshead barrels every year. The vast majority of these casks are never available to the public but are kept by the distilleries for release in their own single malts or sold wholesale for blending.

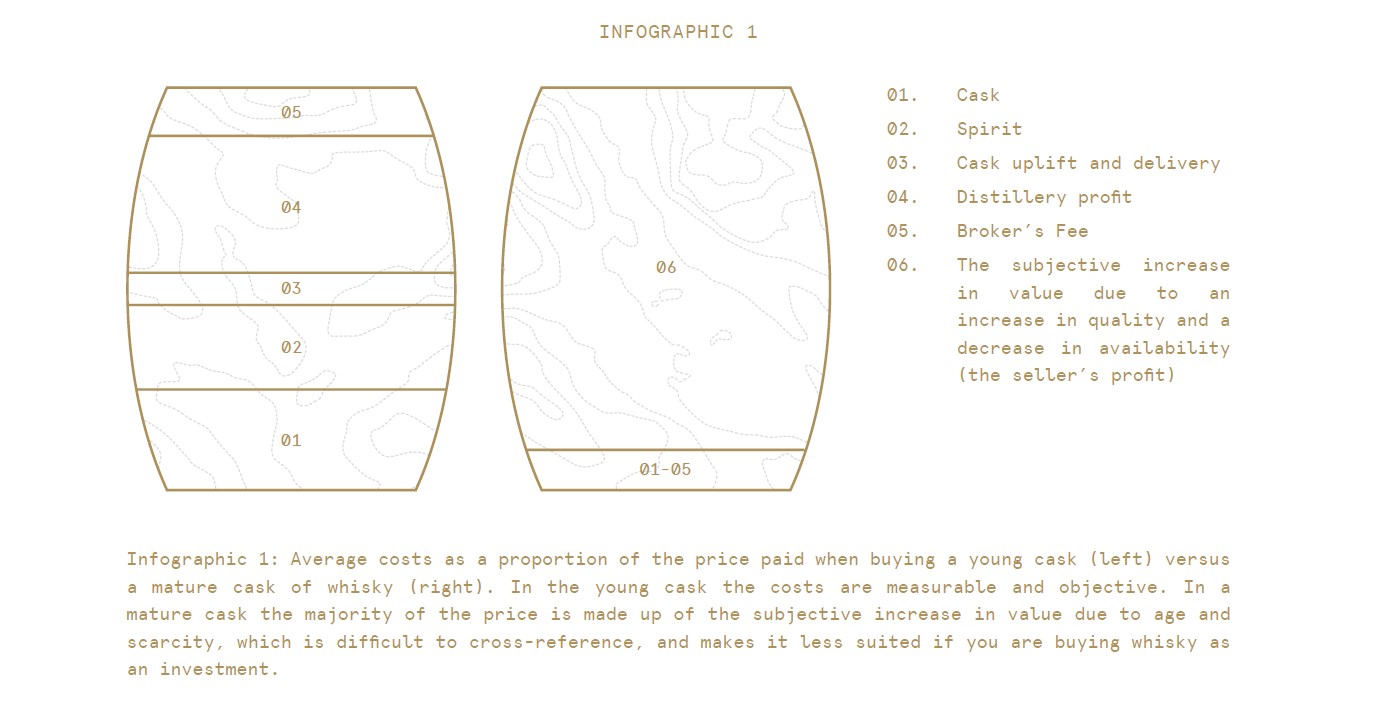

The intrinsic value of a new cask of whisky to a distillery is the cost to make the spirit plus the cost of the cask itself. That cost is unique to each distillery and can vary significantly between casks; an ex-bourbon hogshead is worth significantly less than an ex-sherry puncheon.

For the sake of this discussion, let’s say a cask costs the distillery £500.

From then onward the price is based around two considerations: the number of casks purchased and the distance down the purchase chain which you are buying the cask; the basis for any wholesale to retail pricing framework.

Bulk discounts

In almost all industries pricing works on economy of scale, where you will be charged less if you buy more of a product. Whisky is no exception.

For example, if you are a whisky blender buying 1,000 casks the distillery may ask you to pay £550 per cask, giving them a 10% profit which equates to £50,000. An independent bottler buying 500 casks may pay £600 a cask, which still provide £50,000 profit to the distillery.

As the number of casks purchased goes down the percentage mark-up goes up so that the distillery can maintain their profit margin. A cask dealer looking to buy a mid-range amount of around 100 casks will be expected to pay somewhere between the super-wholesale prices discussed above, and the ‘retail price’ discussed below.

A member of the public who may only want to buy one or two casks will be expected to pay a ‘retail price’ for that cask (please note that we do not mean the whisky will be priced at the bottled retail price which is calculated differently once the cask is mature). The standard mark-up in the whisky industry is at least 60%. As such, continuing with the example began above if an example cask’s intrinsic cost to the distillery is £500, a member of the public could expect to pay at least £1,250 to buy that cask directly from a distillery.

The purchase chain

If you are buying a cask of whisky further down the chain then the cost increases as subsequent sales add their own margin onto their original cost. There are advantages and disadvantages to buying a cask further down the chain and these are discussed below.

New whisky casks are available for the public to buy via two main avenues:

- Direct from a distillery

- Via a whisky broker (or dealer)

New casks are occasionally available via auction, but as these are purchased further down the chain (rather than being entered by a distillery) you can consider them similar to option 2 for this discussion.

Buying a cask direct from a distillery

Casks and barrels that are sold directly by distilleries are usually sold by distilleries when they are looking to release funds from their casks without having to wait 3+ years for the stock to be classed as whisky. New distilleries or distilleries looking to make an investment in their brand will sometimes release casks in this way.

Buying a cask directly from a distillery used to be the cheapest way to buy a cask, starting at around £1,000 even for a cask from a more established distillery. Distilleries have upped their prices in recent years to reflect the greater awareness of the potential profits to be made from casks. Casks sold in this way are usually all from comparable stock, so when you come to sell your cask there can be a lot of similar casks on the market, which can impact the profit you will be able to make on the cask.

Choosing to buy a new cask from a newer distillery before they invest into their brand is one way to speculate on increasing the profit available from your cask. For example, casks of Macallan and Springbank could be bought for only £2,500 in the 1990s, Macallan since invested heavily in their brand and as such these casks have appreciated much more rapidly than other casks purchased around that period.

It is now impossible to buy casks of Macallan or Springbank except as older casks on the secondary market. This is true of many established distilleries as they generally have no need to release funds from their casks in this way and so do not make casks available for the public to buy direct.

Buying a cask from a whisky broker

Whisky brokers act as intermediaries between the cask industry and the public. As such a whisky broker has access to a wider variety of casks, often from distilleries, private bottlers and blenders who would not sell casks direct to the public.

The casks available from brokers are often from a more diverse stock. Therefore, when you come to sell them you are less likely to be selling your cask in a market where lots of similar casks are already available.

What is the difference between a broker and a dealer?

A broker connects someone who has something to sell with someone who wants to buy that something, they usually work on a commission or fixed fee basis. Mark Littler Ltd. are brokers and we charge a flat fee of £300 +VAT on each cask bought from us. If you want to sell a cask we charge 10% (inclusive of VAT).

A dealer is someone who has their own stock which they then sell on. A dealer’s profit is the difference between what they paid for the stock (often purchased in bulk) and what they charge a prospective buyer, as such it is usually undisclosed.

Buying a cask from a whisky dealer

As touched upon earlier, a whisky dealer will likely receive some discount for buying a parcel of casks. These casks are then sold on to the public with the dealer’s margin added. If the dealer’s margins are transparent then this can be another way to get access to unusual casks.

However, as a dealer would usually buy bulk parcels of casks to obtain a discount you can sometimes have a similar issue to buying direct from the distillery, whereby a number of similar casks may appear on the market at the same time around anniversaries and the annual rent/insurance billing times.

If you would like more information about buying a cask from Mark Littler Ltd then please sign up for our free cask buying guide.