Buying a cask of whisky can be a great investment. Historically returns on whisky have been positive, and as the whisky market continues to expand due to a growing international demand we would not expect this situation to change. The Scotch Whisky Association recognise that casks can be a personal investment opportunity but potential investors should be aware of the nature of the Scottish whisky industry in order to assess offers.

We believe that when casks are purchased for a fair price, as a long term investment, and with a comprehensive understanding of how the whisky cask industry works, then casks can be a sound investment. We state that with authority because we have sold millions of pounds of casks for our customers; helping them to make between £5,000-£147,000 on casks which they bought for £1,000-£3,000 in the 1990s-2000s.

However, experience also shows us that when casks are purchased for more than their market value, as a short-term investment, by consumers who do not have a full understanding of how the whisky industry works then their potential as investments is severely limited, if not removed completely.

Just like any other investment (in property, shares etc) it is crucial therefore to do your research ahead of a purchase. You need to ensure you are putting your money in the right cask, for the right reasons, and that you understand when the prime time to enter and exit that investment is likely to be.

We have written a comprehensive guide that you can sign up to and receive for free, but if you want a brief overview then read on.

How investing in whisky casks works

The principle of investing in whisky casks is that the value of whisky in a cask increases with time. This is because the quality is perceived to increase with age as the whisky interacts with the cask, and also because the scarcity of the spirit increases over time. Scarcity increases for two reasons – firstly 90% of all casks are bottled before they reach 12-years-old – meaning that casks older than 12-years-old are rare, and secondly an average of 2% of the whisky a year is lost to evaporation (aka the angel’s share).

So, casks are cheaper when they are younger, and more expensive as they get older. Therefore, if you buy a young cask and hold on to it until it is over 12 years old then you have the basis of investment in whisky casks. Crucially, the relationship between scarcity and age means that value of casks increases more rapidly as they get older; the relative jump in price between 5 and 10 years is smaller than the jump between 15 and 20. HOWEVER this does not mean that you can simply buy an older or mature cask as a way to make casks a short term investment.

Buying older casks of whisky

For the sake of clarity, at Mark Littler Ltd we use three terms when talking about the age of whisky; new make, young casks and mature casks.

What is New Make?

New make is the spirit that is not yet termed whisky, it can specifically refer to whisky that has been distilled in the current year. We use it to describe spirit that is not yet whisky, i.e. is less than 3 years old.

What is a Young Cask?

We use the term ‘young casks’ to refer to any casks that are still in the slow growth period of their maturation; generally 3-12 years.

What is a Mature Cask?

When we refer to ‘mature casks’ we are generally talking about casks older than 12 years. These are less suited to long term investment.

With those age distinctions clarified, let’s explain why you need to take care when buying mature casks.

- Firstly, casks do not age indefinitely; at some point either the cask will evaporate completely due to the angel’s share, or the alcoholic strength of the cask will drop below 40% and the cask is no longer legally whisky. Either way the cask becomes worthless. It is crucial that you buy a ‘healthy’ cask if you are looking for a mature cask as an investment.

- Secondly, it is imperative that you purchase mature casks for a fair price that is representative of its market value. A mature cask’s value is much easier to manipulate and so you must take extra care to ensure you are not overpaying. Overpaying means you will have to keep your mature cask for longer in order to make a profit.

Why is there such a big difference in returns on cask investments?

The average value for casks we sell for our customers is around £10,000-£50,000. Sale values range from £5,000 and the most expensive single cask we have sold being £147,000. You may be wondering what the difference is between these casks and what the secret is to achieve above average when you come to sell?

It is important to find the right buyer, and a good broker will help with this.

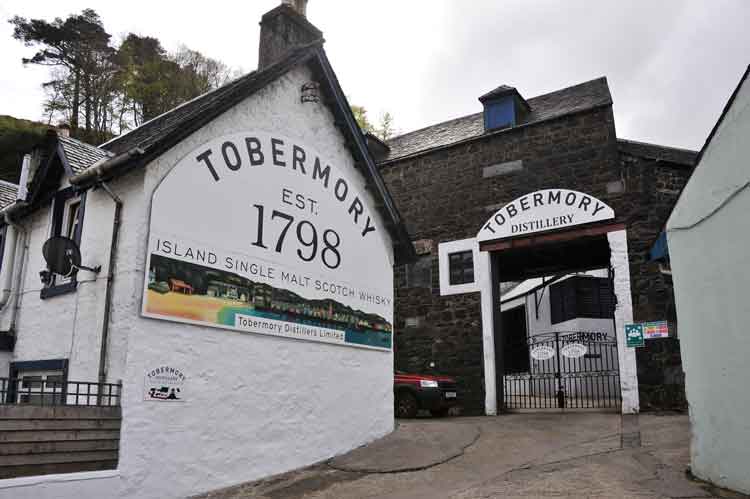

However, the brand of your chosen distillery will also make a significant difference to the premium it can command when you come to sell. It will come as no surprise to anyone with a bit of whisky knowledge that the £147,000 was for a cask of Macallan. There are other casks that command a premium too: Springbank, Ardbeg, Bowmore, Caol Ila, Lagavulin and silent distilleries like Port Ellen are just a few examples that command a premium in today’s market, however they also command a premium to buy as young casks – if you can get one at all.

The customer who bought that cask of Macallan purchased it for around £3,000 in the 1990s, which was a premium at the time but nothing compared to what you would have to pay to buy a young cask of Macallan in the current market – if you were lucky enough to be selected for one. They simply bought the right cask at the right time; knowingly or otherwise buying a cask from a distillery that was about to have millions of pounds invested in it as a brand. There is not really a ‘trick’ therefore, it is more that an understanding of the industry can help you to buy the right brand at the right time.

Buying with established brands gives a good scope for a solid return on your purchase. Buying a cask from a distillery that is less established but which you expect to have a large investment in a brand is one way to try and speculate on higher returns. Bruichladdich is another example of a brand that’s had a lot of investment in marketing since it re-launched in the early 2000s, making the casks that people bought when they were relaunching now worth a premium compared to what they would have been otherwise.

Are whisky casks a good investment for me?

It is important to assess whether any investment is right for your circumstances and casks are no different. You need to ask yourself the following questions:

-

Can I afford to have my capital tied up in a long-term investment?

Casks should be considered a long-term investment. If you think you will need the money back before the cask is mature then you should consider putting your money elsewhere. It can also take time to release money from a cask in order to find the right buyer and get the most from your purchase.

-

Do I need regular returns on my money?

Casks do not provide rent or dividends during the length of the investment. If you need income from your money then casks may not be right for you.

-

Can you afford the annual charges?

There are some annual charges associated with storing a cask, including rent and insurance. You will also need regular regauges to keep an eye on the cask’s health and ensure your cask remains profitable. You need to calculate these into your costs when looking at a cask.

-

Do you understand the cask industry?

Do you have a basic understanding of the industry so you can be positive about your investment? Do you understand how you might eventually exit your investment? If you are considering bottling your cask, do you know the costs, VAT and duty involved? Are you aware you can sell a cask in bond, and what the benefits of each option are?

In addition, we would always suggest speaking with an independent financial advisor about potential investments.

Importantly, we believe that casks can be a good investment as long as you stick to these three guiding principles:

- Purchase a quality cask for a fair price

- Buy a young cask with the intention to keep it until it is mature

- Have a clear understanding of the industry you are looking to invest in.

If you would like to learn more about buying a cask of whisky then you can sign up to receive our free Cask Buying Guide. It covers everything you need to know about the industry so you can make an informed decision about becoming a cask owner. Sign up here.

Send me my free cask buying guide

Simply fill in form below and we will post your 52 page guide to get you started on your whisky adventure.